Dow: +262.95…

Nasdaq: -159.93… S&P: -4.97…

The S&P 500 declined 0.1% today, as another rotation out of growth stocks and into value stocks contributed to a lackluster performance in the SPX. The Nasdaq fell 1.4%, while the Dow (+0.9%) and Russell 2000 (+1.9%) posted solid gains in catch-up trades.

TNA vs. TQQQ

Today buyers felt inclined to increase exposure to economically-sensitive companies and other value-oriented stocks within the energy (+2.5%), consumer staples (+2.0%), industrials (+1.8%), materials (+1.1%), and financials (+0.7%) sectors.

The Nazzy is still feeling the aftermath of the vaccine. The stay at home names, and there are many, are still getting whacked. See ZM. Beyonce saved Peloton’s (PTON) ass today.

When the sellers feel like they are done, there will probably be some good oversold long opportunities.

Gold was up a little today, silver was flat. Still watching the group and I like this dip, but not pulling the trigger yet.

A vaccine won’t cure massive printing and rising debt, but they sold the metals to buy other stuff anyway. The cheaper the better for entries.

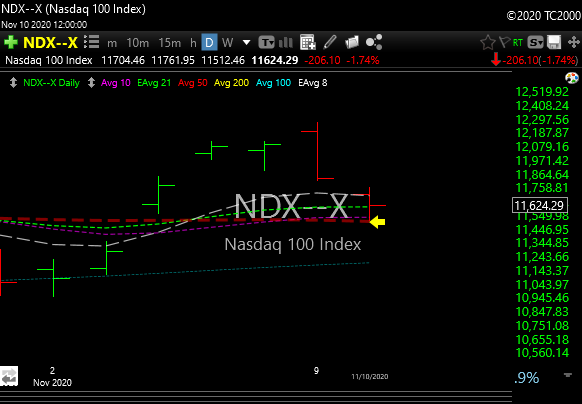

The weakness in Nasdaq is the topic of conversation right now, but NDX and QQQ held 50-day moving average support today and bounced a little.

I didn’t give up on the remaining half of QLD yet, so maybe a bounce is in the offing.

AMZN -$342 in a week. Probably doesn’t stay there. Maybe another $75 lower first though.

We all know that Japan not only buys their bonds, but their stocks and etf’s too.

Today they implemented a new policy, whereby they will offer a facility paying banks 0.1% if they either cut costs or start doing M&A. BoJ really wants banks to clean up their act and remove the zombification.

Yes, one of the central bankers is encouraging takeovers.

Cant make it up.