Dow: +113.37…

Nasdaq: +37.61… S&P: +16.20…

The S&P 500 gained 0.5% today, although it was up as much as 1.5% ahead of a stimulus meeting between Speaker Pelosi and Treasury Secretary Mnuchin. The Nasdaq increased 0.3%, the Dow increased 0.4%, and the Russell 2000 increased 0.3%.

Pelosi and Mr. Mnuchin were still negotiating at market’s close, which may have caused some hedging activity for any disappointment. Nevertheless, ten of the 11 S&P 500 sectors still closed higher, led by the energy (+1.2%), financials (+0.8%), and communication services (+0.8%) sectors, while the consumer staples sector (-0.1%) closed lower.

Evidently the White House has made an offer of $1.8T.

A lot of money guys are looking at the “short” tech and “long” staples trade for the new year. It could be an interesting sector rotation, but no reason to jump the gun.

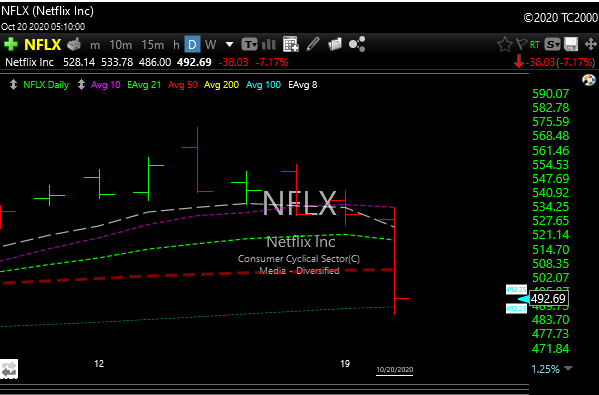

NFLX reported earnings after the close, the # looked ok but they guided a little lower than expected on revenues. It’s down about 7% in aftermarket trading.

I added LAC as a new long. The stock has a beautiful bull wedge in process. The red line is the current stop area which is right at lateral support and just below the 21-day moving average. 14 and 15 are short term targets, then maybe the high at 17. Great chart, lets hope it does what it’s supposed to do.

Some of the Sunday watchlist names that re still looking very bullish include: SPCE, MBUU, CARR, and GVA.