Dow: -131.40…

Nasdaq: -32.28… S&P: -16.13…

They pulled some bids today in front of the election. Sellers, meanwhile, made their presence known in the S&P 500 energy (-2.7%) and financial (-1.2%) sectors, more so the energy space given its outsized decline amid weaker oil prices ($39.20, -1.34, -3.3%).

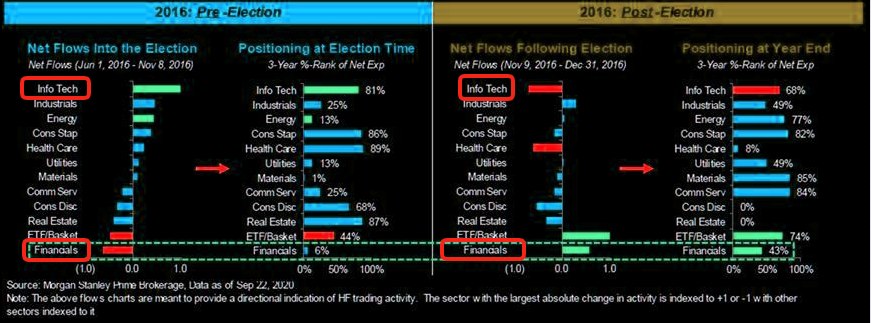

Interesting flow data that shows what hedge funds did ahead of the last election, how they were positioned and what they did post-election.

One key finding: they were buying tech and selling financials going into the election and positioning was extreme in that direction, and then flows started reversing rather dramatically post-election.

Most sectors were red with the exception of biotech today (XBI) which showed good relative strength +1.3%.

A coupe of highlighted names ZI and AMD outperformed. ZI missed that gap fill target by just a couple of pennies.

We’ve seen some bullish action for the last three days. I don’t think tonight will upset that too much.

Enjoy the debate if that’s your thing. Do a shot every time you hear “tax returns” or “Hunter Biden”. You’ll be hammered twenty minutes in.