Dow: -405.89…

Nasdaq: -221.97… S&P: -59.77…

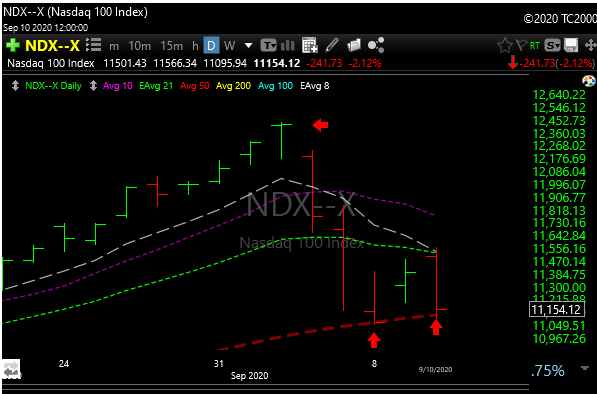

The chasers got face smashed today. It happens sometimes. The bulls needed a follow-through day today to confirm yesterday’s action but didn’t get it, so yesterday was just a blip for now. The bulls need to defend their territory.

The market rallied hard out of the gate after three hard days down, but the sellers showed up at around 11 AM and the selling continued.

The market is a tad squirrely right now for whatever reason. Maybe the upcoming election, maybe the fact that extended unemployment benefits have dried up, and PPP is over. Maybe because so much tech is still silly overvalued.

My four horsemen of tech, FDN, VGT, IGV, and SMH all ended up closing at or around their 50 day moving averages, so that’s good, but if those levels break then we could see more selling.

The financials are under pressure, XLF (big banks) failed at its 200-day moving average and KRE (regional banks) broke 50-day moving average support.

GS writes;

“US single stock call option volumes averaging $335bln/day over the last two weeks, approaching notional volumes normally traded in index put options”.

So much unbridled speculation lately.

That is all you need to know. Off…..the…..chain.

Washout was needed.

So it was a bad few days, but to worry too much is probably silly because the Fed just won’t be able to help itself.

GS writes;

“We continue to expect that substantial asset purchases will be required beyond the current PEPP envelope to maintain loose financial conditions in the face of persistently low inflation and increasing sovereign bond supply. Our base case remains that the Asset Purchase Program (APP) is stepped up significantly as PEPP ends in mid-2021”

Healthy market huh?…. I love the word “required” in the above quote.

Futures are up about 0.3%. Tomorrow is another day.