Dow: -353.51…

Nasdaq: -244.71… S&P: -40.36…

It wasn’t a good day for the S&P 500 information technology sector (VGT-2.6%). That is a rarity for the sector, which, entering today, was up 55% from its March 23 low and up 19% for the year.

This slide happened following Microsoft’s (MSFT 202.84, -8.91, -4.2%) earnings report. That report, however, wasn’t bad. It was simply not as robust as investors’ lofty expectations. What was bad was the reaction to the report, which was a trigger for selling across the sector.

Anyway, these stocks needed a rest. The FAAMG stocks needed a slap across the face.

The main thing for the bulls is the hope that this was just a one off and nothing more.

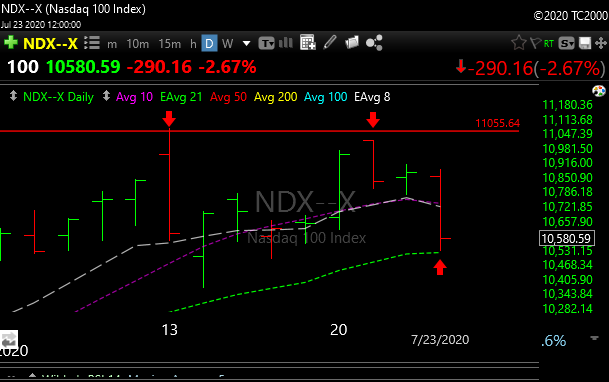

As I have been saying, the NDX 21 day moving average needs to hold. If it does, then it just a buying opportunity, if it doesn’t, then we could be in for some more selling.

It came within a hair of that level today and bounced. How long can those 5 stocks carry this market?

Interesting note on TSLA.

The last time it traded 60% (yes 60%) over its 200-day moving average it topped out. It’s now 61% over its 200-day moving average. Your call on this one.

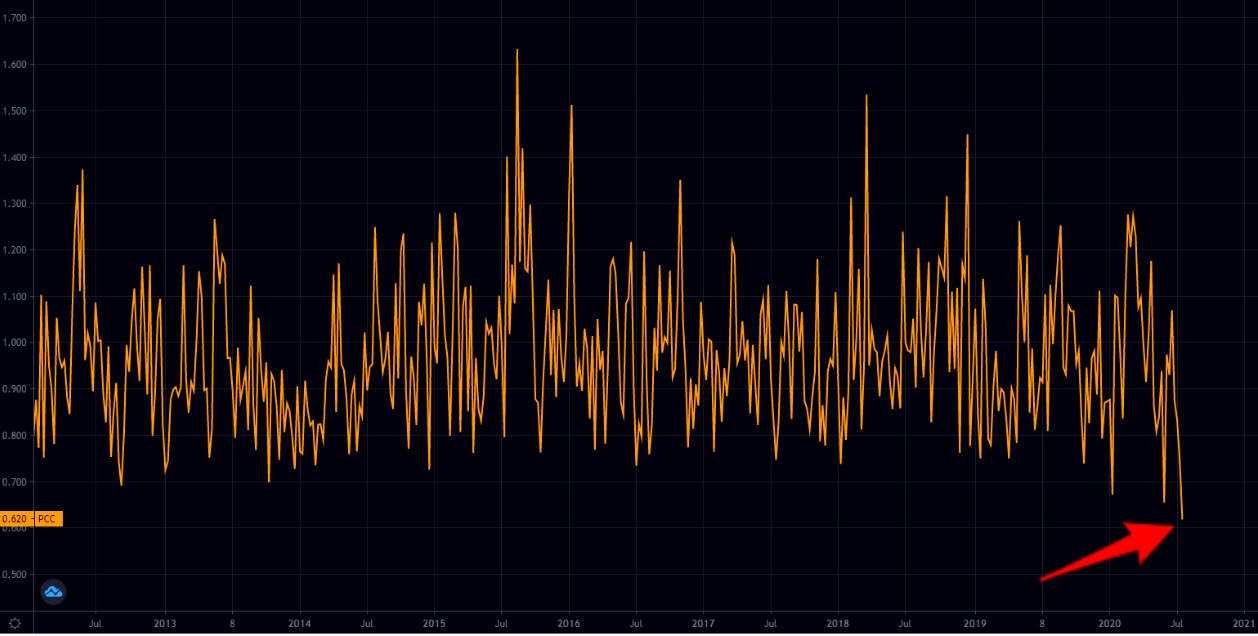

Meanwhile everyone is bullish. Put hatred hasn’t been this low in forever.

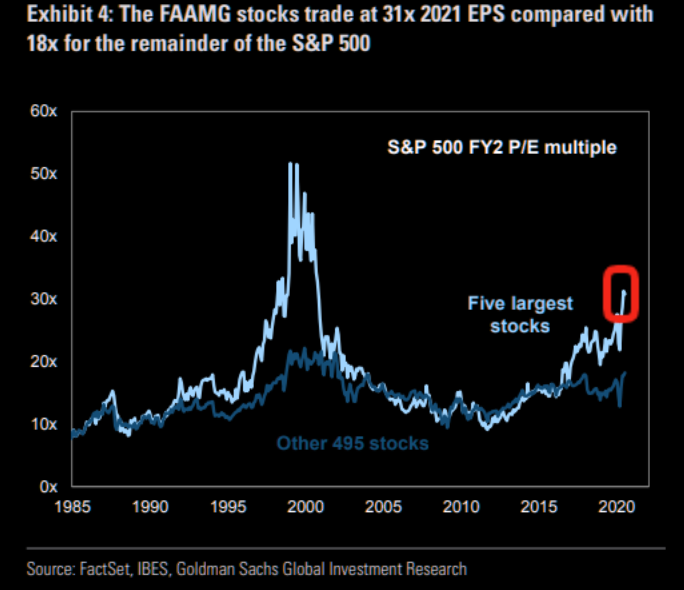

Its all about FAAMG.

FAAMG stats………

FB, AMZN, AAPL, MSFT, and GOOGL now account for 22% of the S&P 500 market cap, it was at 19% in January 2020 and 16% a year ago.

FAAMG is + 35% YTD, compared with -5% for the remaining 495 S&P 500 stocks.

Each stock has set a new ATH this month. Even God is long these 5 stocks.

From above, 1 year performance, AAPL, AMZN, MSFT, GOOG, FB.

Silver and gold took a well deserved rest today.

PAGS stopped when the Nazzy rolled today. The last time I was stopped this fast was when I asked Kim Alexis if I could buy her a drink at Maxwell’s Plumb in 86.