Dow: +369.21…

Nasdaq: +69.69… S&P: +32.99…

Cyclical and value stocks lead market higher to end the week and there was relative weakness in the information technology and health care sectors.

The S&P 500 financials (+3.5%) and energy (+3.3%) sectors rose more than 3.0% amid expectations that these beaten-up sectors would outperform in a recovery. Just the day before they were down on “growth” worries, so how fast the tune changes. The health care sector (-0.2%) ironically closed lower while the information technology sector (unch) took a breather.

The indexes were all unchanged or down slightly for the week with the exception of the Nasdaq which just keeps going led by the big cap tech names.

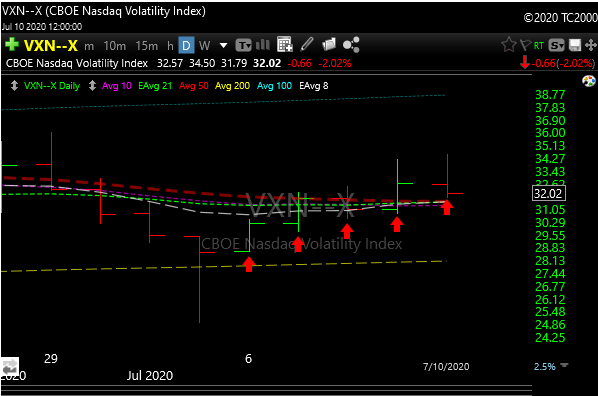

Even though the Nasdaq seems to move to new highs everyday, we are seeing protection starting to get bought.

As you can see below, the VXN (VIX for the Nasdaq), had an up week even though Nazzy printed all time highs.

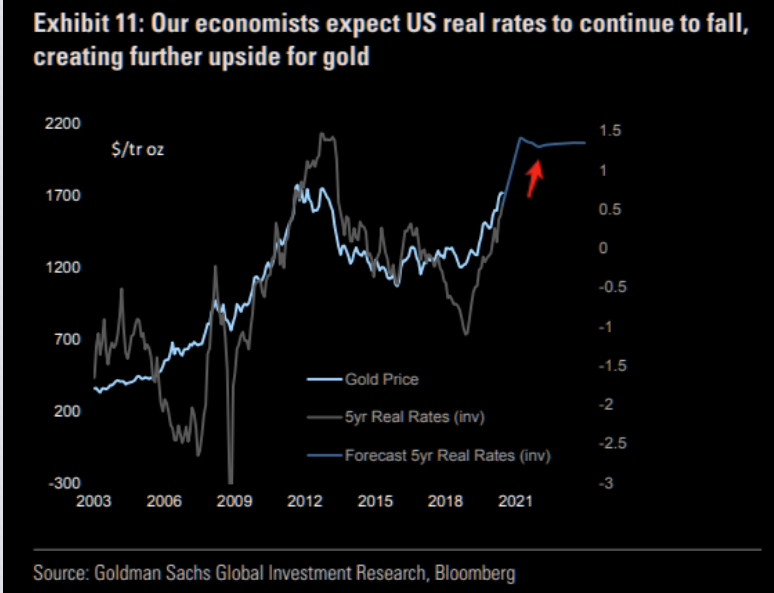

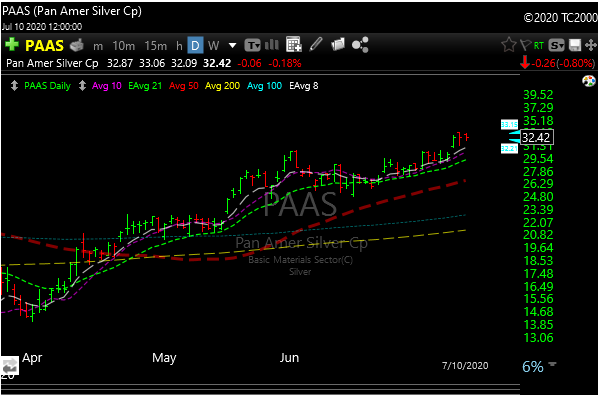

Gold and silver both had decent weeks and broke out.

If rates stay here or go even lower, along with a weak dollar, then the metals should hold their bids and rise further.

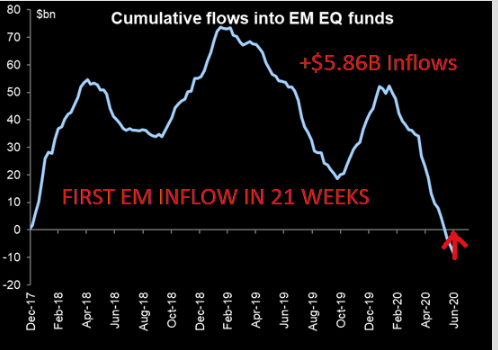

The market is starting to look for laggards to buy because there is a lot of froth out there right now. We are seeing emerging markets (EEM) continue to get a bid, so if this continues there may be some bargains in this space.

The watchlist names from last weekend’s post did very well this week with the exception of BBBY. ROKU, NVAX, and BE exploded.

Some of these names don’t always make the P&L, just idea generation for your own watchlists.

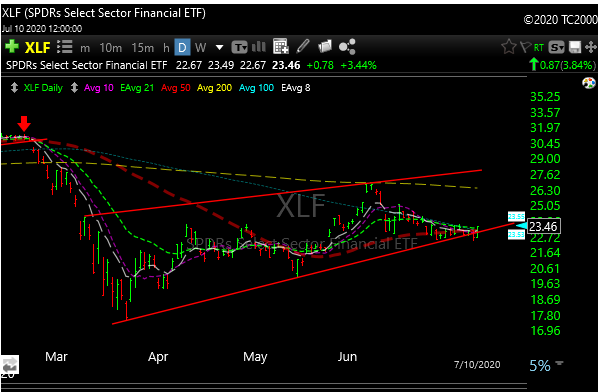

The banks are at a big spot here. As you can see below, it’s right on its trend channel lows. Earnings kick off next week so they will probably guide how that chart plays out.

The Russell broke its channel last week. Keep in mind that the Russell really does track what KRE (regional banks) does. Bank earnings are coming. If they are good, then KRE could rally, so there might be a long side trade in IWM. I’m still bearish financials though, so they are guilty until proven innocent from my perch.

Regarding FOMO, there s still a lot of cash out there. When will asset managers and leveraged funds start buying? If they do, watch out above.

In a lot of ways, it’s getting giddy and silly now. It really is. I would expect a pullback, albeit temporary, at some point soon. This is not normal behavior. We have Fed support granted, but an economy that has zero earnings visibility.

Look at the FAANG stocks as a group. Up 15% in a week after an already massive move? Getting goofy.

I added 4 new longs last week. AGQ, PRPL, FLDM, and FPRX.

Here are some longs on my watchlist for the coming week.

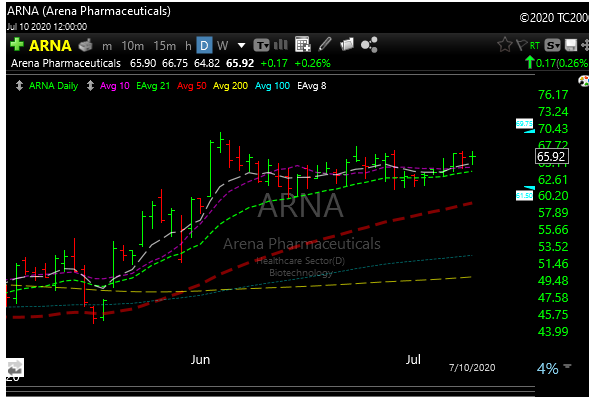

ARNA– is a biotech that broke out hard back on 6/2. It has been coiling bullishly ever since and may be ready for another leg higher. Above 68 on volume it could see mid 70’s.

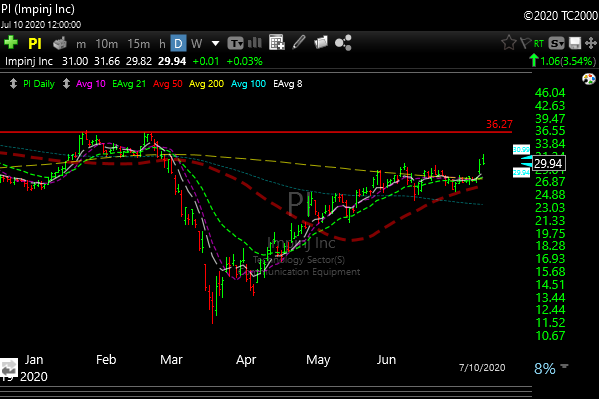

PI– caught a breakout last week and may want to ahead up to make a triple top at the 36 area.

PAAS– is a silver miner that I have mentioned before, and if you own SIL then you already have exposure to the silver miners, but this one does look high 30’s low 40’s over time.

MRNA– I’m only 50 points late on this one, but if it can get above the 67 level on good volume it can get back to the 85-90 zone. Keep in mind this is COVID vaccine stock and if it doesn’t work it probably goes back to $10. Much higher risk, so buyer beware. The technical pattern is fine though.

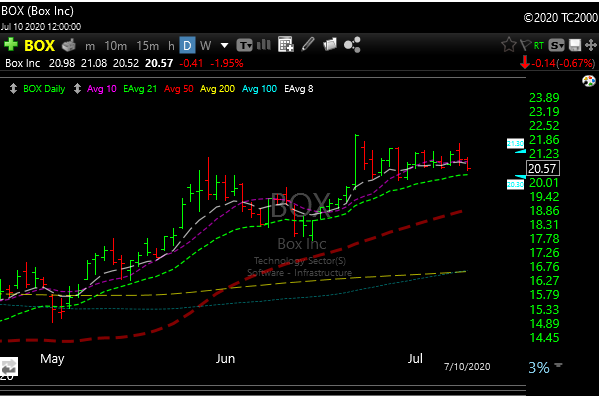

BOX– has been coiling bullishly after its breakout back on 6/22 and is still holding its 21-day moving average. If it can get back up above that 21.50 level on good volume it may head towards 23.

Have a great weekend.