Dow: -208.64…

Nasdaq: +3.07… S&P: -17.60…

- Nasdaq Composite +10.9% YTD

- S&P 500 -4.1% YTD

- Dow Jones Industrial Average -9.4% YTD

- Russell 2000 -15.0% YTD

The SPX bounced off some support starting Monday and put in a decent week until it ran into some profit-taking on Friday.

There are so few down days lately, that when we do have one, the bears get all ginned up and call it the start of a prolonged pullback, but the reality is that we don’t get that selloff.

Bottom line, they are still buying the dips.

There were some bearish candles on most of the indexes on Friday and the volume was a bit elevated so we will see if the bears want to start something here.

I continue to look at the charts of IGV, FDN, SMH, and, VGT with amazement. They have all made new all-time highs recently and continue to hold their ground but these are the ones that will have a “come to Jesus” meeting when the time comes.

Everyone is jammed in the phone booth on these sectors.

Be careful with the airlines and cruise ships here, especially cruise ships. They have run, but aren’t close to booking anyone on there floating Petri dishes yet. CCL, RCL, and NCLH look like shorts to me. Maybe not long term shorts, but not bad for short term shorts.

Not Out of the Woods Yet

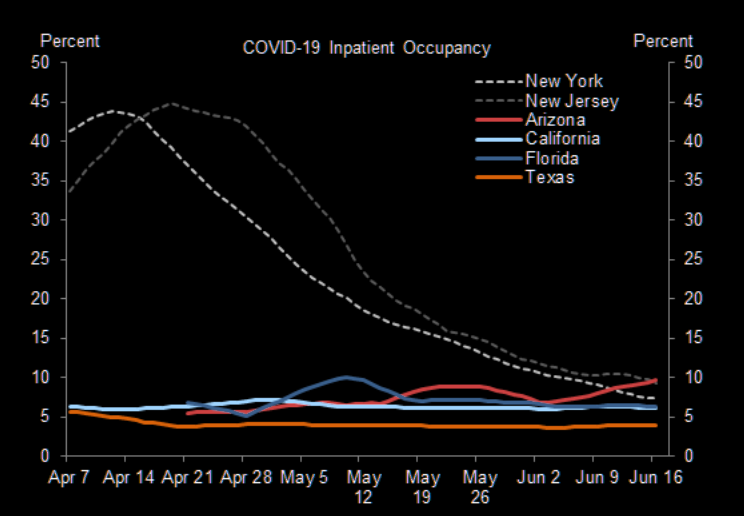

Arizona, Florida, and California report noticeable increases in COVID-19 cases, so the market reversed as caution prevailed.

Israel has entered a second wave of coronavirus infections and, if it does not take immediate steps to bring numbers down, could in one month’s time face a thousand new cases a day and hundreds of deaths, a military body coordinating information on the pandemic has said.

Dayanglu Market, Beijing’s 2nd largest market after Xinfadi, halted its retail business on Sun to curb the spread of COVID19. There are 3,061 vendors in the market, whose meat, poultry and egg transactions account 50% of the city’s total…

But hospitalizations remain relatively low.

AAPL is reportedly planning to temporarily re-close some stores again due to COVID risks, so that also put a damper on optimism.

The week that was.

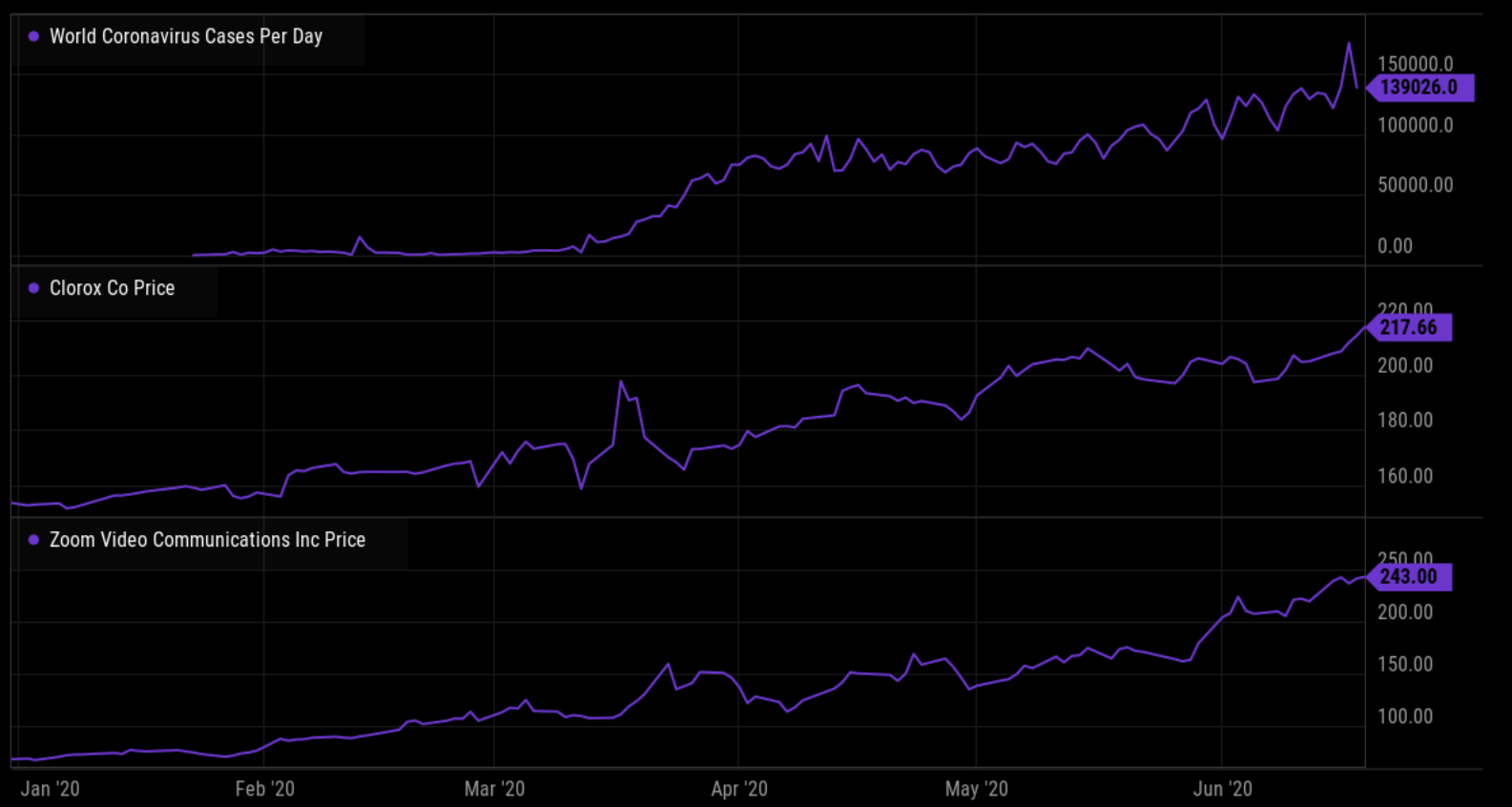

As I mentioned last week it was a little scary to see CLX and ZM both make all-time highs. These are COVID stay at home names.

If they ever get a vaccine, CLX will be a helluva short, more so than ZM.

A few names I will be watching this week are:

STNE– Hit resistance Friday and backed off. Through 40 zone get it to 44-45

WW– Possible pullback buy.

USCR– needs to get over the 29.50 zone.

ADAP-up a lot, but working on a beautiful falling wedge.

AMD– has been coiling for a month, watch for a possible breakout move.

BBBY- looks like its getting accumulated. It got plugged at the 200-day moving average but through the 10.80 zone can run to 13.

See you in the morning.