Why did we get hammered?

Covid outbreaks are happening again in certain states. (Gonna be a bitch if this gets worse).

We were overbought as we have gone too far too fast.

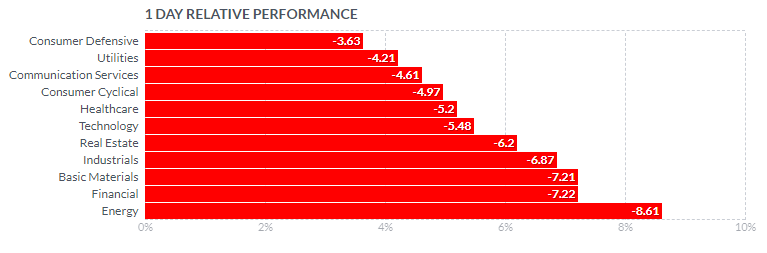

Oil got hammered.

Cautious outlook from the Fed.

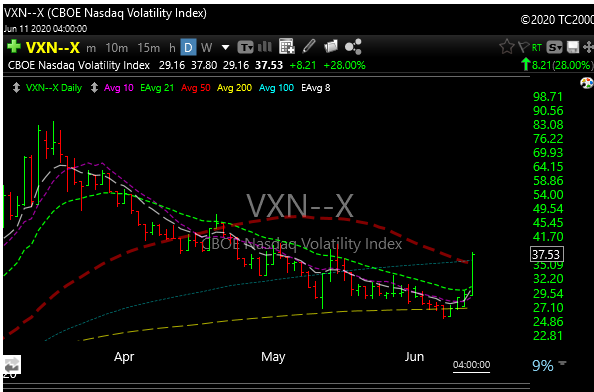

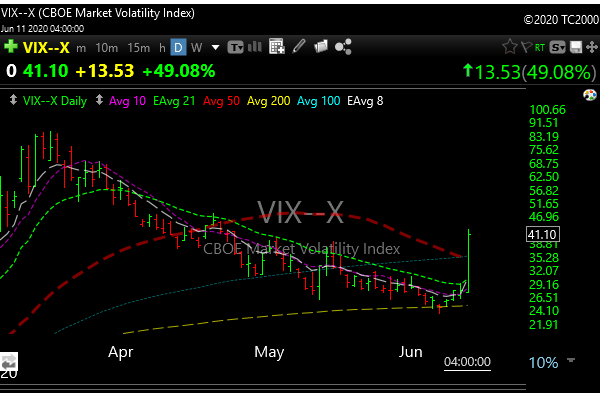

I think it was last night that I mentioned the VIX and VIXN as bullish and that I would buy those charts with both hands if they were stocks.

Today VIX +49.0% and VXN +28.0%. No end zone dances, I saw it, but didn’t get short. Its one of many signals I use but it was odd that VIX and VXN (Nasdaq VIX) were up the last couple days with an “up” market. Counterintuitive to say the least.

As I said last night, they were just stunningly bullish falling wedges. Today they exploded. And plenty of time to buy at the open. UVXY ran 53% today. Crazy.

Oh well, they pull the rug when you least expect it.

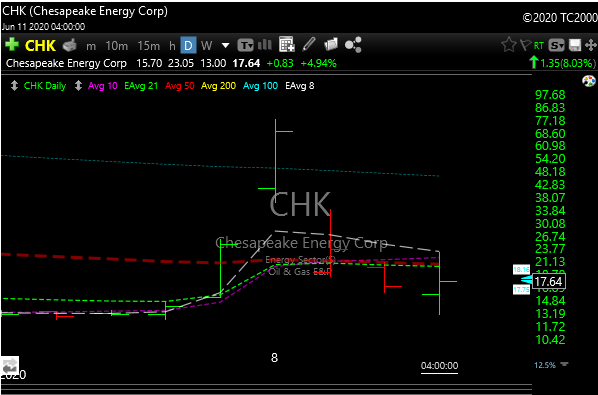

Want to see a psycho stock? CHK went from $14 to $78 and back to $17 the last 3 days. Insanity. The algos are now crackheads.

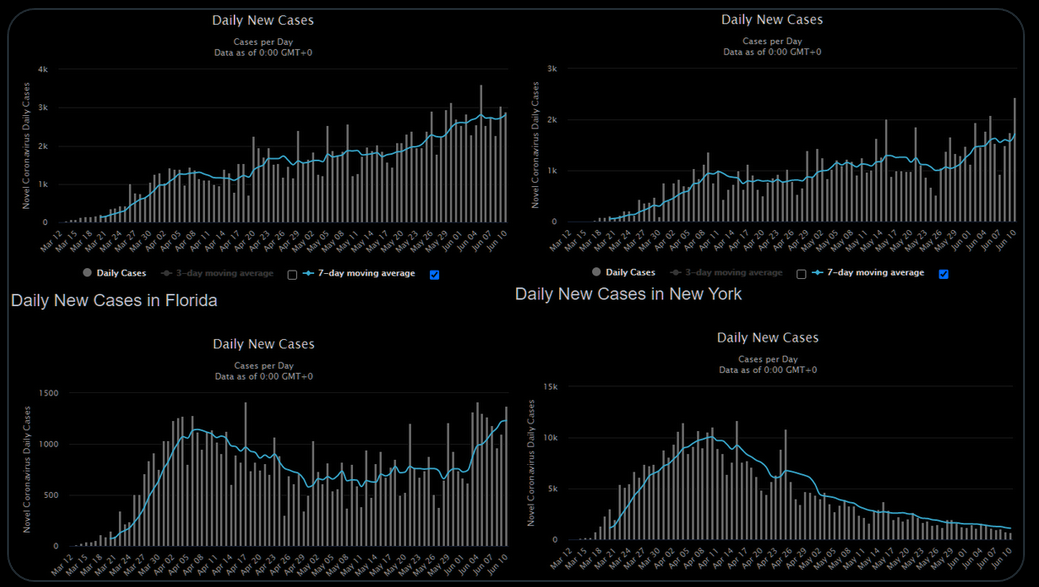

A 7-day average of new COVID-19 cases in the 3 largest US states (California, Texas, and Florida) hit a new high today while the downtrend in the 4th largest state (New York) continues.

The FAANG stocks were bludgeoned like baby seals today (the most highly owned). We’ll see of the dippers step up tomorrow or if they just let em go.

So much for the strength in the banks. Treasury yields going down again, kryptonite for the banks. KRE -9.3%.

It ain’t a real market when stocks and sectors act like this.

Boeing didn’t help the Dow today. What’s the difference between COVID and Boeing? COVID is airborne.

SPX broke its 21 day and 200 day moving averages today, we’ll see if we get a turnaround Friday or not.

The hot sectors that we’ve talked about that were at big risk of a pullback did get hot hard today: IGV, FBN, SMH and VGT.

It happened pretty fast today so it was tough to get any shorts, but they should set up on bounces.

I’m down to 3 longs, one of which opened below the stop (ET), so oil is going to need to bounce.

Here is the updated P&L.