Dow: +91.91…

Nasdaq: +62.18… S&P: +11.42…

Reopening enthusiasm carried the market higher despite weekend protests, simmering U.S.-China tensions.

Small-caps, financials, airlines, cruise lines, and energy stocks were among biggest gainers; mega-caps outperformed, too.

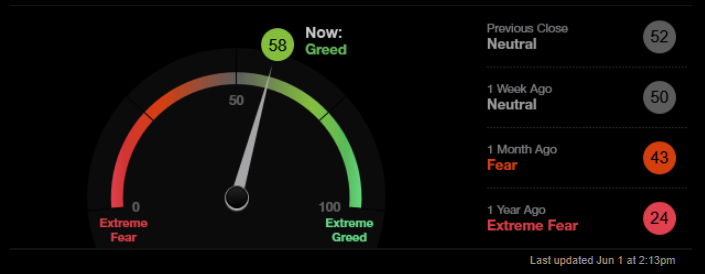

That needle has FINALLY moved to green on the “greed-o-meter”. That needle can go further right before we get a meaningful correction. The market peaks on greed, bottoms on fear. Greed isn’t that bad yet, but it’s moving up.

The ISM Manufacturing Index for May ticked up to 43.1% from 41.5% in April. This the third straight reading below 50.0%, which is the dividing line between expansion and contraction.

The market could care less about bad earnings and the ISM # though. As long as the Fed enables this insatiable appetite, the pigs will stay at the trough.

I added R as a new long today. A move through 36 with volume looks like 39-40 short term. Right at resistance.