Dow: -390.51…

Nasdaq: -49.72… S&P: -30.97…

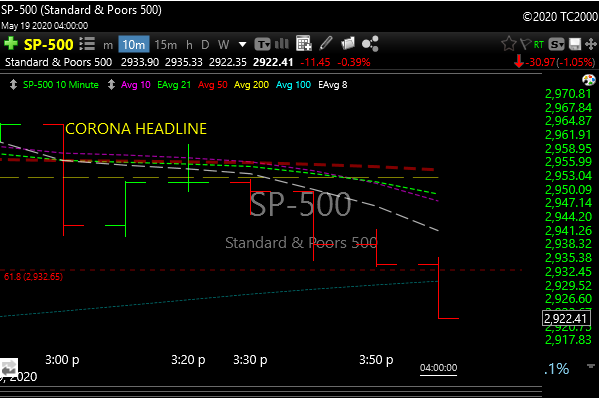

SPX 10-minute chart

Remember all the China Phase 1 trade headlines a while back? The market would throw us around like a rag doll every other day, week after week. You needed a Dramamine to help smooth out the swings.

After yesterday’s vaccine hope injection, we caught a headline today, right at 3 PM, that the “experts” cautioned about MRNA’s Covid vaccine because they needed more data. No shit Sherlock.

That headline was innocent enough. Unless you’re an idiot you know that its not approved yet, it may never be approved.

The algorithms kicked the sell orders in, and that was that. Yes, algos have language, buzz words, and buzz phrases already programmed.

Anyway, that headline knocked the SPX down 40 points in an hour and the DOW lost almost 400 points in an hour.

The market needed an excuse to take some profits after yesterday’s huge overreaction, and the vaccine headline was the excuse.

So vaccine headlines could be the new thing going forward.

Right now the risk to the bulls is a second wave of COVID at some point, the risk to the bears is a vaccine. No one knows where we will land, so expect pops and drops within a trading range.

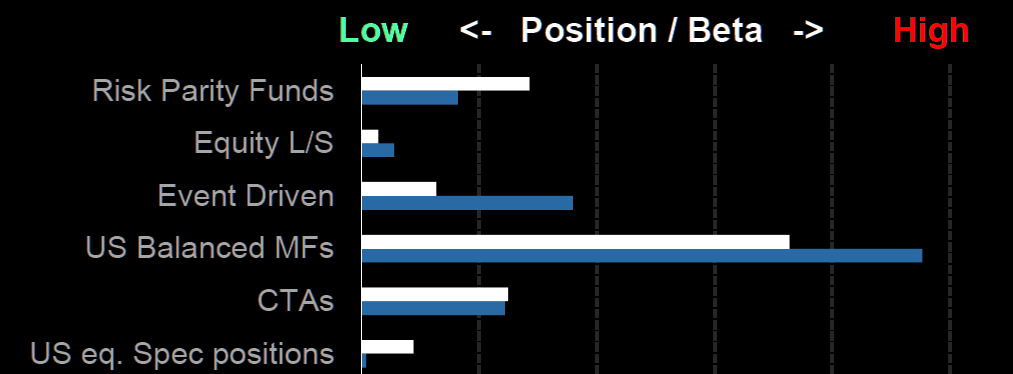

This is the one indicator that has been helpful in not going max-short this rally during April. This extreme positioning warrants caution if you are going to trade along side it…

It seems the long/short guys aren’t playing at all.

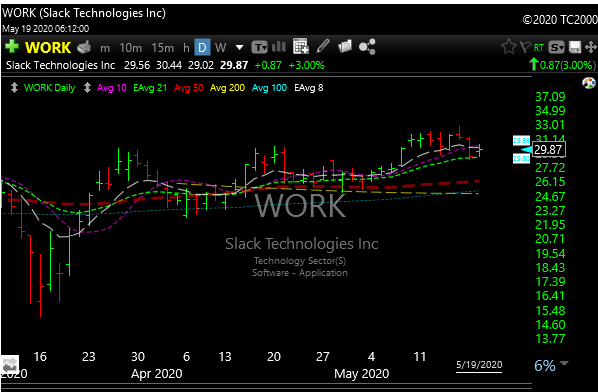

I added WORK and XLU today.

XLU has a nice V bottom and a long bull coil so far. If it can move above the 57.50 level on a closing basis with volume I can see 60-61.

WORK– has been bouncing off the 21-day moving average for the last two days. Needs to get above 30-31 with some volume, but then low 30’s. I have a tight stop on this one just in case.