I told you last week that Warren Buffet was getting flayed in his airline stocks. After he said he would never sell them, an SEC report showed that he dumped a lot on the way down in March.

Then this Saturday he revealed that he has subsequently sold every single share of every airline stock that he and Berkshire owned.

Buffet’s weekend quote….

““I don’t know that 3-4 years from now people will fly as many passenger miles as they did last year …. you’ve got too many planes.”

For a guy that owned a pantload of those flying tube steaks its interesting that he said this not that long ago.

“If a farsighted capitalist had been present at Kitty Hawk, he would have done his successors a huge favor by shooting Orville down,” Buffett wrote in his 2007 annual letter. “Investors have poured money into a bottomless pit, attracted by growth when they should have been repelled by it.”

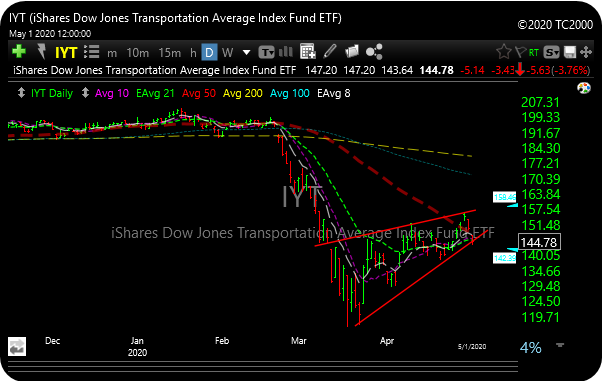

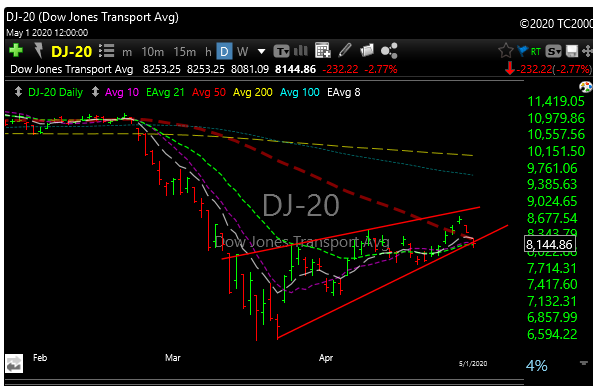

This probably won’t play well tomorrow for the airlines or the transports, so watch that bear wedge on IYT.

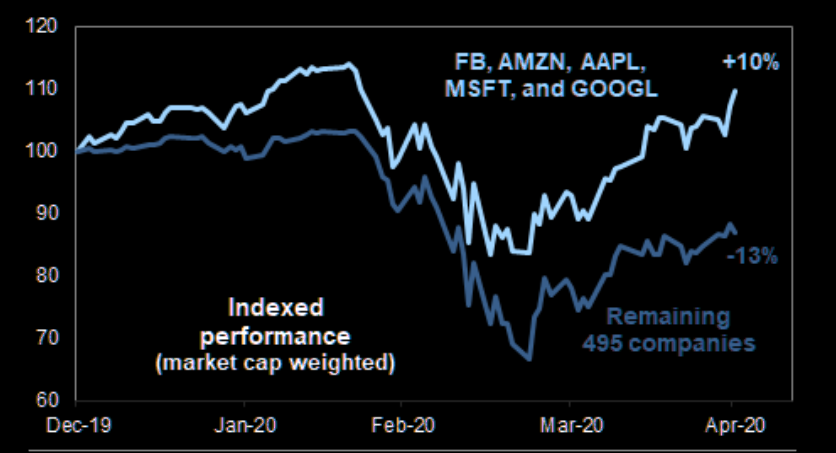

The market took a hit Friday, down 8% for AMZN. All of the FAANG stocks have now reported so it will be interesting to see if the market lightens up on these names going into next quarter.

It was a weak day for breadth on Friday with just 28 advancers and 476 decliners in the S&P 500. Also, the first Friday decline since April 3rd.

Narrow breadth is usually resolved the same way: The relative outperformance of market leaders eventually gives way to underperformance.

Everyone wants to “open up” but 30% of bars and restaurants will never open again unless they get more government assistance according to the Financial Times.

Was Friday just a one-off? Maybe. If you look at the SPX since we bottomed, it seems that we have seen mostly all of the down days get bought the next day. So buying the dip has been pretty obvious. When they stop buying the dip is when bulls should worry.

The VIX popped 25% last week and bounced right off its 100-day moving average.

The Nazzy broke the uptrend Thursday and followed through lower on Friday as it hit double-top resistance.

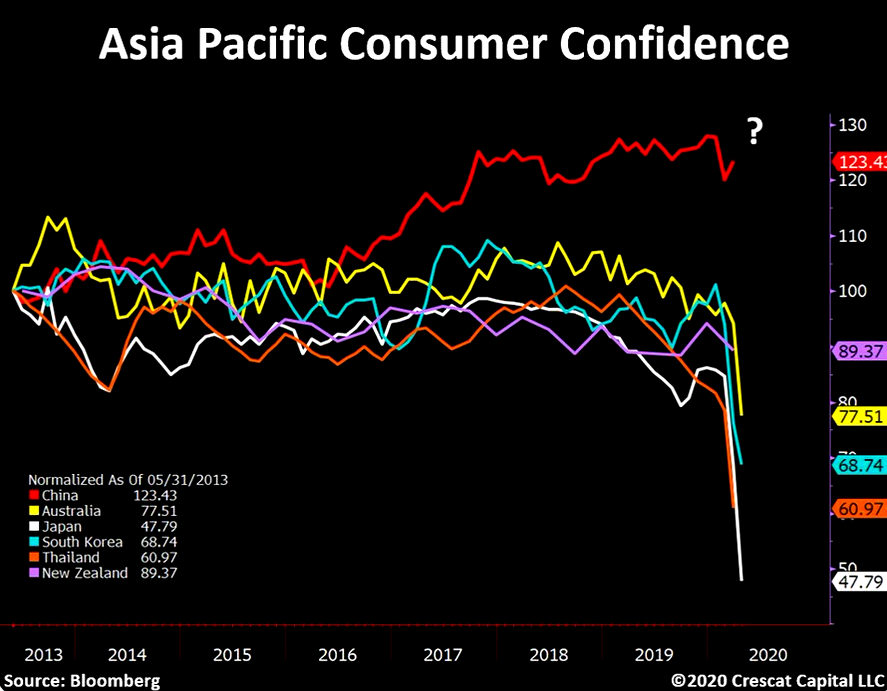

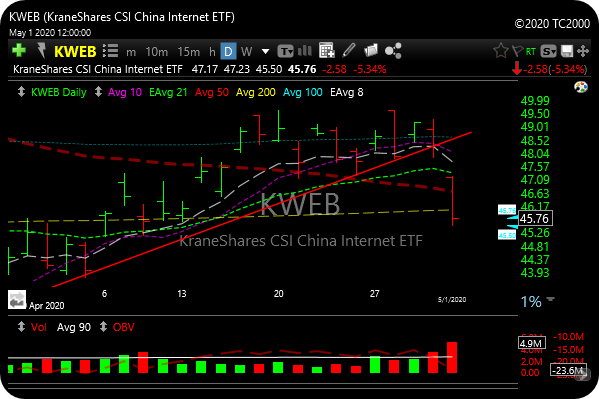

Consumer confidence is collapsing in most major countries in Asia Pacific, but not in China.

Still, I don’t hate this one as as short.

Cocktail party banter….

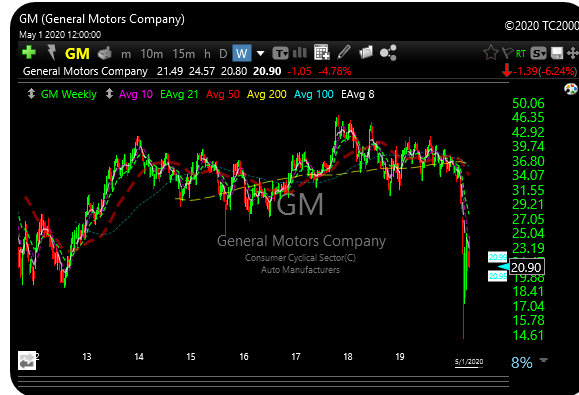

GM bought back $21.4bn of stock since 2012, a significant number not just because it represents roughly 2/3 of the current market cap of the company but because MS Analyst Adam Jonas calculates the combined capex and R&D of Tesla since its IPO to be approximately $20bn. What if GM allocated its $21.5bn towards electrification or accelerating new electrical architectures, operating systems/software, and autonomous technologies? Would it be in a stronger position today? Or a weaker position?

Look at the chart of GM since that massive joke of a buyback started in 2012.

Also, IBM has spent $140B on buybacks under the last CEO and saw 24 quarters of revenue declines.

Stock price over those 24 quarters.

Invariably stocks buybacks which I personally detest benefit CEO’s, board members, hedge funds, and activists that advocate for that activity.

I can only imagine a world where I could see organic growth and legit stock performance without companies always hanging around on their own bid.

But then how would they ever beat earnings? Issue debt but tighten the stock float…..has worked like a charm for 10 years.

I almost bought some things Thursday, but that Fib level ended of being the fail spot at least for now so I’m glad I avoided longs. ROKU was an example of an outstanding chart on Wednesday, almost a perfect set up, but it got throttled on Friday. It pays to be patient.

It still looks good as long as it holds that 21 day moving average (green line).

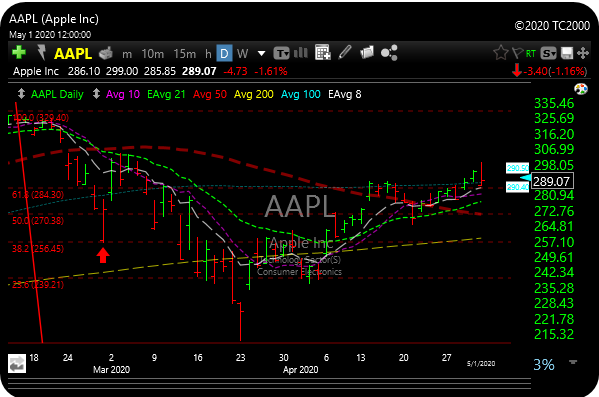

Apple bulls like to talk about the “200B” of cash & securities on AAPL’s balance sheet. That’s no longer true. Apple does still have $192.8B in cash & securities, but now also has $110B of debt (& rising fast). Net cash is down to just $83B & almost certain to fall again this qtr.

AAPL hung in well on Friday but reversed bigger gains.

Regarding that cool triple top breakout on XLE. Well, its back under the breakout.

The semiconductors also broke a few things on Friday. Its uptrend line, its 21, and 200-day moving averages.

Catch you tomorrow. I want to see if the bulls step up this week or if they let the bears have their way with things for a while.