A strong session for US stocks as this morning’s medical news and confirmation of significant Fed liquidity accommodation massively overwhelmed the horrible GDP report.

Regarding that rebalancing, there was $1.6 billion in “market on close” orders versus yesterday’s $600 million to sell.

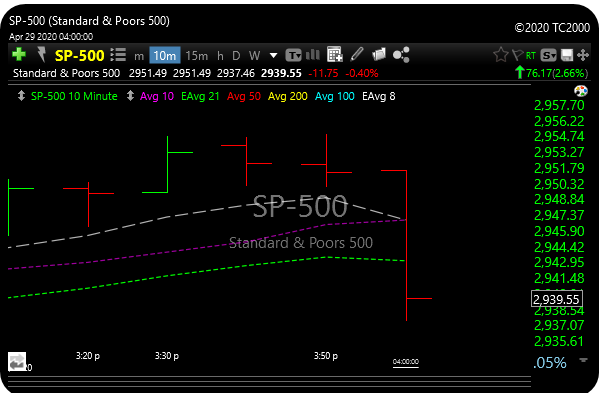

The sell orders did drop the indexes over the last 15 minutes of trading, but nothing dramatic. Probably more to go tomorrow near the close. SPX 10-minute chart below.

Technology saw an outsized move today after a better than expected earnings report from GOOGL after the close last night.

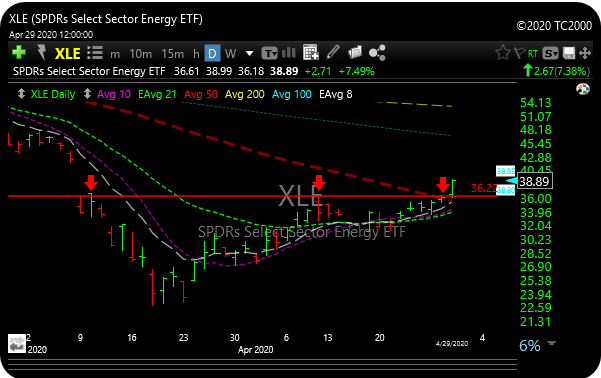

Crude AND energy stocks both had an up day together for a change. The big 3 that I have been talking about for a few weeks, APA, SLB, and ET just don’t stop.

Trump has been briefed on a plan for aid to oil drillers beset by historic crash in oil prices. Energy’s Dan Brouillette has mentioned bridge loans and emergency lending authority through Federal Reserve to help small/medium sized players

XLE broke out of that triple top with impressive fashion on good volume.

Speaking of tops, XBI looks a little tired after yesterday’s ugly action and today’s underperformance, but maybe it just needs a rest.

Tech was hot today as semiconductors (SMH), software (IGV), and info. technology (VGT) were all on a mission.

The VIX is being hammered but the market is still pricing in 1.7% daily moves for the SPX.