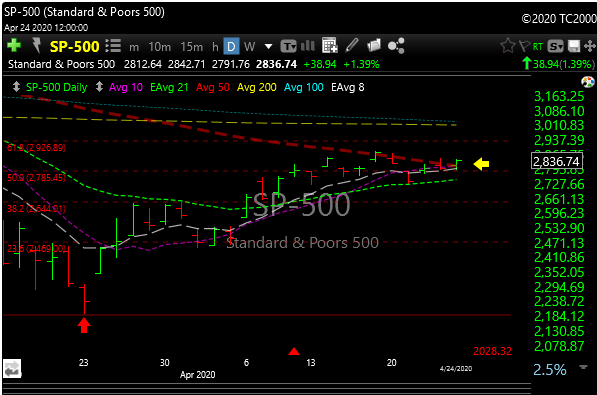

The SPX managed a close on Friday above its 50-day moving average for the first time since April 17. The volume on the SPX and QQQ was pretty light though.

The bulls are still holding serve here which is impressive. As the brilliant Stanley Druckenmiller always said: “earnings don’t matter, just watch what the Fed does”.

Now that earnings are truly meaningless, maybe his point will really resonate.

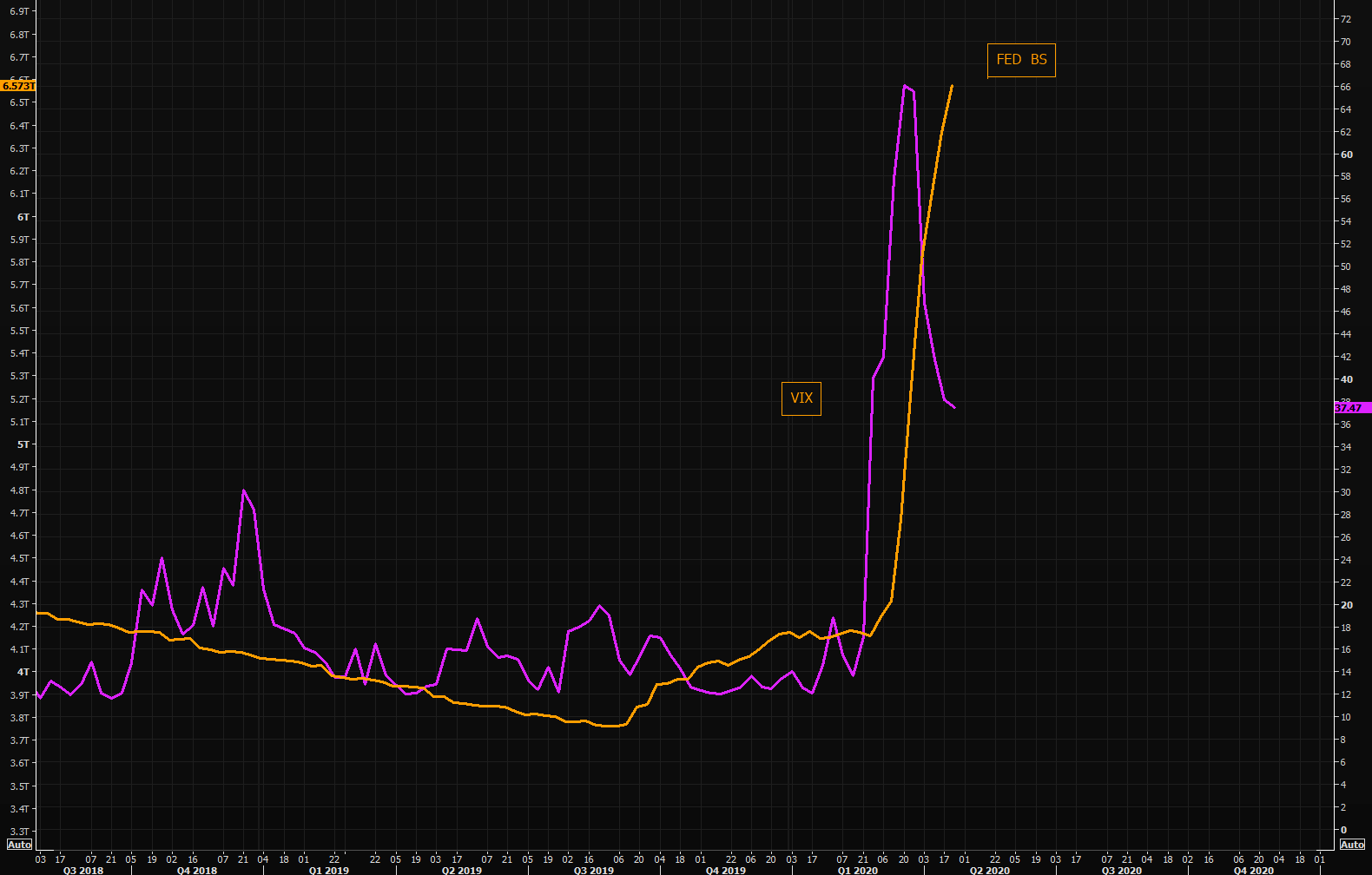

Take a look at the VIX and the Fed’s balance sheet below. As the Fed BS expands, the VIX drops. The Fed is king and cures all ills for now.

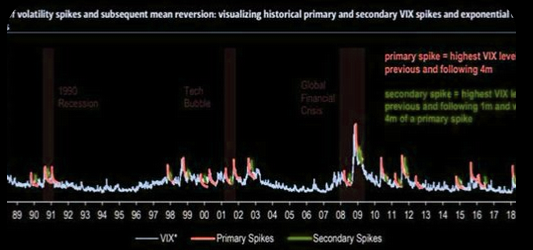

However, a long term view of VIX during periods of spikes – is almost always met with a secondary spike, particularly in recessions. So that means there is a possibility of a retest of market lows.

There is a saying on Wall St. that “buyers are higher”. Order flow traders and old Wall St. floor specialists know this.

It means that buyers would rather “pay up” after they’re convinced a move is real and has the ability to “stick”.

Oil made it through one of the craziest weeks in history. There was contango all over the place. Most of the newly minted crude experts last week think contango is a Spanish dance. You can google oil contango if you want to learn what it is.

If you ever get a chance to go to a cocktail party or a barbecue again, you will sound really smart when you throw out this fun fact.

In nominal terms, it’s not a surprise to see that, over the 150 years for which we have data, there’s never been a negative price print before. This is stunning as it basically says that a barrel of oil earlier this week was effectively cheaper than it was in 1870. A period over which US inflation has risen+2870% and the S&P 500 +31746505% in total return terms.

I read an interview with Charlie Munger recently, Buffet’s partner. He gave off a vibe that things are different this time. Munger is older than dirt and still trades under the Buttonwood tree, but he has seen it all.

He said in past crashes they were buying with both hands and getting calls from public companies for funding. He said the phone isn’t ringing this time (maybe that’s a good thing), but he said he and Warren aren’t buying anything.

As a matter of fact, they were selling when prices got crushed. They hit bids on the airlines all the way down. AMR, DAL, LUV, and others. So they were sellers, not buyers. They took 40-50% hits on the way down and they were choking on airline exposure for a long time.

On March 13 Buffet said in an interview that there was no way he would sell his airline stocks. In an SEC disclosure on April 3 it showed that he sold a ton.

He’s also fairly terrified with the Fed’s money printing and is worried about those chickens coming home to roost.

There are so many differing opinions out there and I have probably gone way to macro lately, I’m just genuinely fascinated by everything at this point.

For every negative I can find you a positive and vice-versa.

Our favorite spread betting site which has been very accurate on weekends has futures about flat right now.

Mark Twain said, “A gold mine is a hole in the ground with a liar at the top”. After getting crushed in the crash and being the shittiest “hedge” ever, gold, silver, and the miners are now ripping again. Bank America just increased its target from $2000 to $3000. I’m done trying to figure out the metals, but if they get whacked again I will take another look.

Brazil has been getting hammered lately and so has its currency. EWZ was down 7% Friday and may trend even lower.

FMC is an American company that gets 25% of its revenues from Brazil. FMC is also right at its 200-day moving average. Maybe a short with a $3 stop. Just an idea.

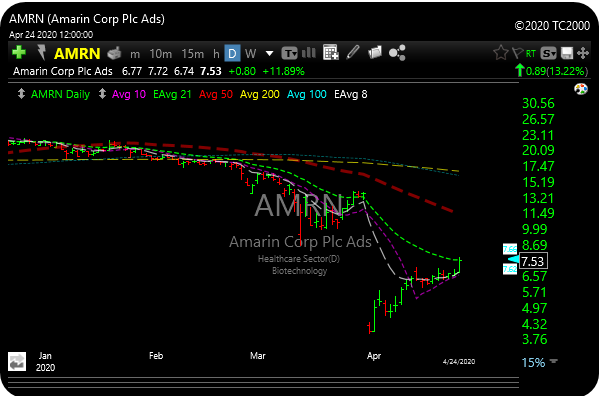

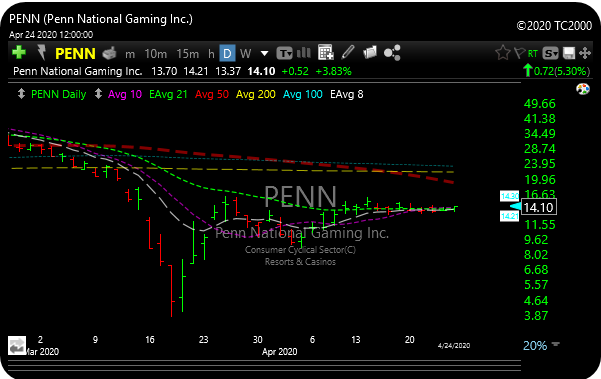

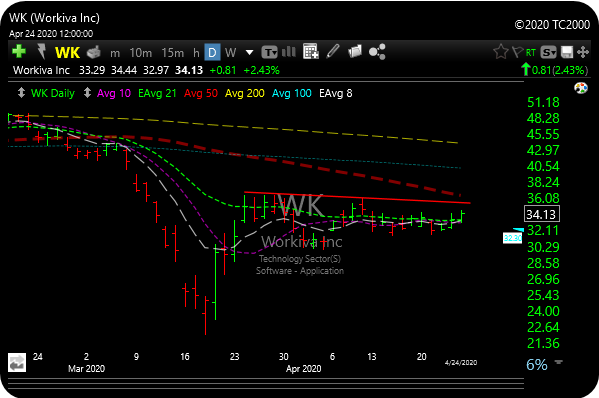

Some bullish chart setups that I am watching for possible entry. I will let you know if I do anything next week.