Oil futures are seeing more pain this morning, with the most-active June contract falling to a roughly 21-year low, a day after the May contract made history by settling in negative territory for the first time ever, as a glut of oil and dwindling places to store the commodity combined to eviscerate crude.

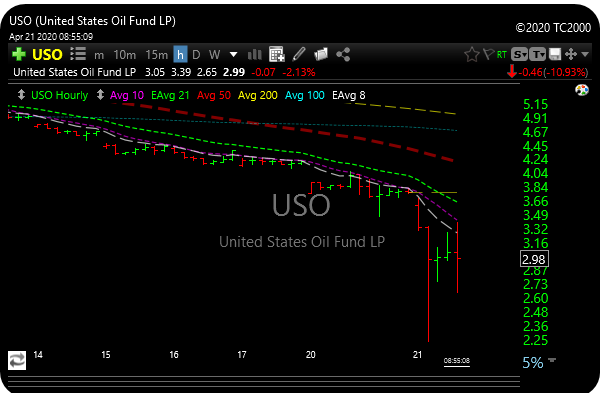

Meanwhile, USO, the go-to crude etf that was down 10% yesterday, is currently down 25% in pre-market trading at $2.98.

Also, UCO, the leveraged long play on oil is doing a 1:25 reverse split here as the price was at a drill bit.

USO also filed last night to increase shares outstanding 4 billion from 1 billion. They were running out of shares.

In case you were planning on attending this year’s Oktoberfest in Munich, it just got cancelled. That’s October, not June.

I’m sure everything’s fine.

Hourly chart