I’ve been barking about all this dry powder that is available from pensions and mutuals for several days now to complete that rebalancing. I believe the number was over $300B when I first posted Sunday or Monday. This was money that is needed to be spent by month end to balance 60/40 pensions and funds.

I sent you a note along with some long ideas this afternoon as the number remaining was about $240B.

This is the largest buy imbalance in history.

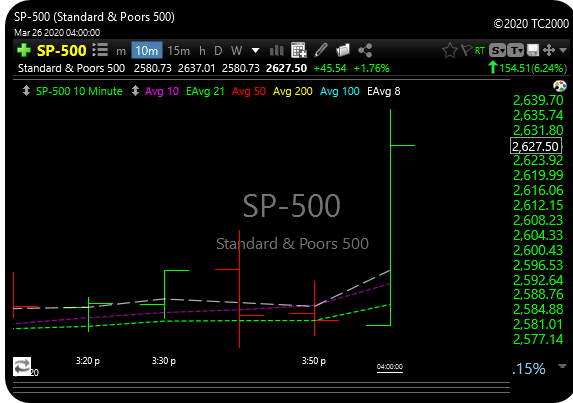

Anyway, if you were watching the market closely today, you saw a massive “spike up” that hit for the indexes, ETF’s and individual stocks.

The reason? There was an $8 billion “buy on close” order from somewhere (re-balance money). Here is what the spike looked like.

A 47 handle move in the SPX in 10 minutes. This ain’t your father’s stock market.

Heres a look at the action in IGV in the last 10 minutes today.

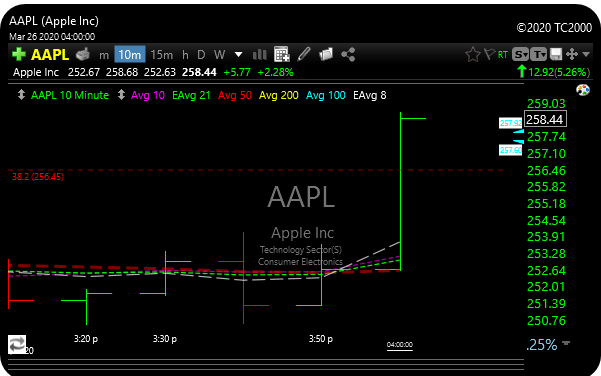

Here was AAPL.

I gave you two targets on the SPX on Tuesday night. The first was hit yesterday and the second target of around 2650 could be hit as early as tomorrow (20 points away). It happens to be the second Fibonacci target. But who knows? Depending on how much liquidity is left for this rebalance we could blast through that too.

How’s this for cocktail party conversation this weekend? Oh wait, you can’t, you’re all still in bubble wrap, but anyway….

If the SPX moves another 3% it would be the fastest move “into” and “out of” a bear market in the history of the market. This is based on the lows Monday. It all happened within a month.

So, less than 3% to enter a bull market again. Whacky, funny stuff.

Don’t get too excited. This is “one-off” stuff in my opinion, but enjoy it while you can. Right now the wreckage is just covered up with pixie dust.

But hey, who knows, if we can get people back to work sooner than later that will be a good thing, but we will have a rocky road ahead of us.

I wouldn’t hate a Friday melt-up. We’ll see. As I said today, the shorts are looking for a dip to cover, the longs are looking for a dip to buy, but the market cares nary a wit and just goes ahead and does what it does.

Have a good night.