You’ve heard me say that the bond guys are always right. That the bond guys are the smartest guys in the room, and the equity guys are a bunch of momentum following dolts and neanderthals.

I’ve never really ever seen the bond guys be wrong so I believe it to be true.

Bond action can be an excellent tool in determining future directional moves in equities.

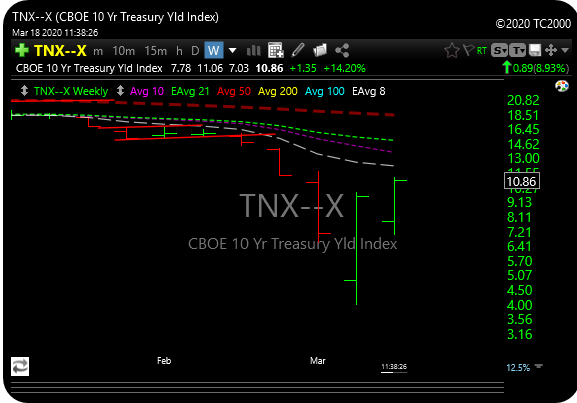

Over the last month, the bond guys (treasury market) bought bonds with both hands and with their last nickel. Rates as you know caved, then the market crashed.

The move in rates was BEFORE the equity market crash, so they are good for this type of stuff.

Anyway, this is the second day in a row that treasuries are getting sold aggressively (yield up). Which, when you drill down, is considered a “risk-off” trade.

Is the bond market telling us we are near a short term bottom for stocks?

I’m not signaling an all-clear by any stretch, but this so far is a very interesting development.

So watch the bond market, there might be a 2-3 day lag for an equity bounce. You never know. Maybe it’s just a blip, but those bond boys can be evil geniuses.