No secret that HYG (high yield corporates) have been bid up forever as the world was thirsting for yield. HYG has belly-flopped as investors in that etf are now worried about corporate bond defaults in this space. These bonds are not of the AAA variety, but more junkish.

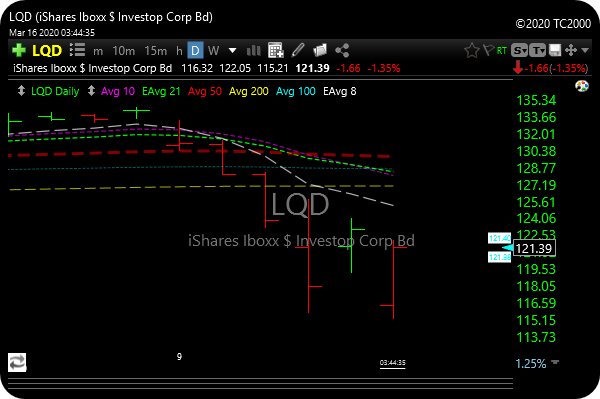

LQD, which consists of more investment-grade corporates was hit hard too but is rallying back today. It seems they are fleeing junk to buy less risky debt. LQD has rallied hard from the open.