I didn’t spend enough time on the metals yesterday and should have because we have/had exposure there.

Seems the only asset class that was green was the treasury market last week. Staples, utilities, gold, and silver (defensive sectors) were all hit, with no exceptions, the baby with the bathwater type stuff.

I’m still bullish gold and silver intermediate and long term so it’s a good time to look at the charts because “time frame” is important.

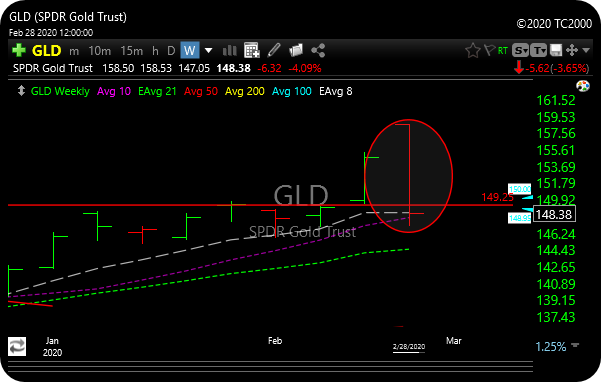

Gold– I will show you a weekly, monthly, and quarterly chart. We know that the daily chart looks miserable based on last week but the better context I think would be to look at the longer time frames.

The weekly chart put in what we call in the technical universe a “bearish engulfing” bar. What’s that? That’s when the high and low of this week encompassed or “engulfed” the high and low of the previous week. This is an event that is construed to be bearish. It doesn’t always validate lower, but its good to be aware.

Yes, it was ugly, but bigger picture, all it really did was go back down and test that massive bullish breakout area around the 149 level which happened back around Feb. 18.

The monthly chart below isn’t as ominous. You see that beautiful bull flag breakout, and a bullish follow-through month in January (actually closed January on the highs).

Want to get nuts and go the quarterly chart which goes back to 2008-09? That’s about as bullish a long term base that you will ever see.

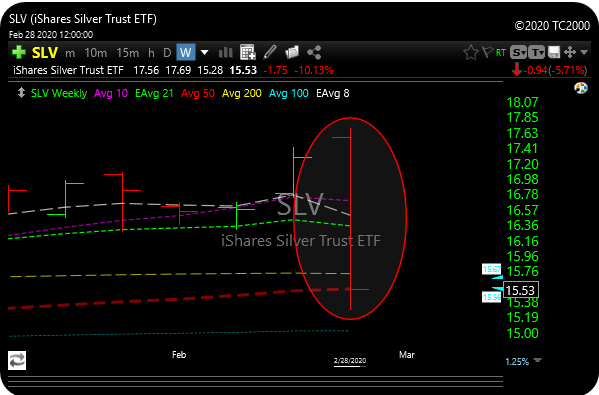

Silver had a worse week than gold, down 5.7% for the week. Here’s the weekly chart below. Same thing. A massive bearish engulfing bar.

It’s hard to see on the chart above, but for whatever its worth, SLV closed right on its weekly 50-day simple moving average to the EXACT penny. Does that mean anything? Not sure, it depends on next week, but it is really cool.

From my perch, there will be some great setups moving forward but it’s reckless to jump in right away, but there are some things I will really want to add going forward.

XLF– I just noticed this today and it will leave it here without too much comment, but the monthly MACD, relative strength, and stochastics have all crossed down negative on the monthly. Mona Lisa of a double top.

We’ll see if the bears are done or not. There wasn’t anything positive on the coronavirus front this weekend. The possibility exists that we go down and test, maybe break Friday’s lows just to shake out the late Friday buyers.

There will be a ton of recession talk again if this doesn’t resolve soon, and that could weigh some more.

We start a new month tomorrow and God knows where futures will open, but I will keep you posted as always.

Hope you had a restful weekend.

This guy has it all wrong.