Dow: +23.90…

Nasdaq: +32.67… S&P: +8.26…

That’s about how far the SPX is away from the all-time closing high. The SPX is up about 30 points this week as the headlines switch from China to Brexit. Yes, I guess people do care about Brexit, but China really is a tough act to follow. China hasn’t gone away, it’s just napping.

Gold caught a small uptick today (+0.14%), silver did better and was +0.86% and the silver miners (SIL) were +about 2.4%.

I don’t know if the metals pullback is over, but the dollar has been coming down and some of the charts are starting to look a little better.

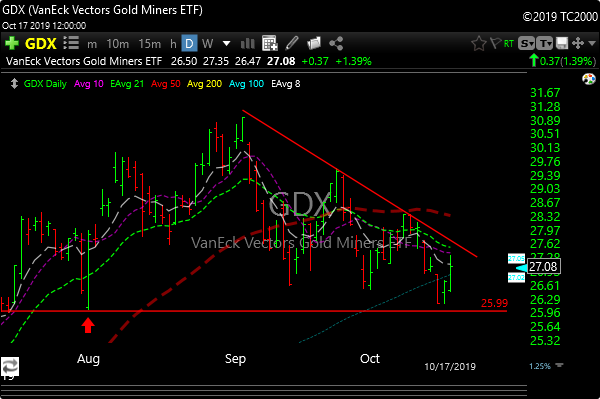

With that in mind, I added GDX as a new long. As I said in the midday email I think the risk-reward looks pretty good. My stop is down around where the Aug. 1 low was. That intraday low was 26, my stop is 25.75. If the miners can attract some bids we could see 3-5 points upside on this one with risk of about 1.25. Its a fairly tight stop.

I also re-added AXSM today. You may remember this one from a few weeks back. We sold it because the action sucked, then the following day or two it imploded, so it was a good “out” if not a lucky out.

Anyway, the company had good news the last couple of days, and the volume has picked up, so it may want to grab some upside momentum again. The technicals are better as MACD, RS and stochastics have crossed up. It also has a micro bull flag cooking.

This is a biotech, so more risk, but the pattern looks promising.