I hope the White House is working on a new tweet because right now the four indexes are right at spots where they could lose their bowels in a hurry.

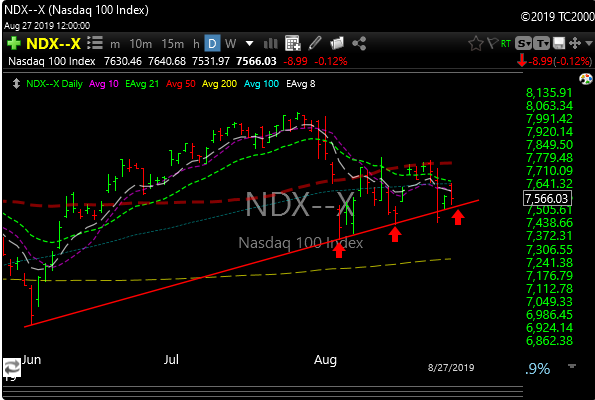

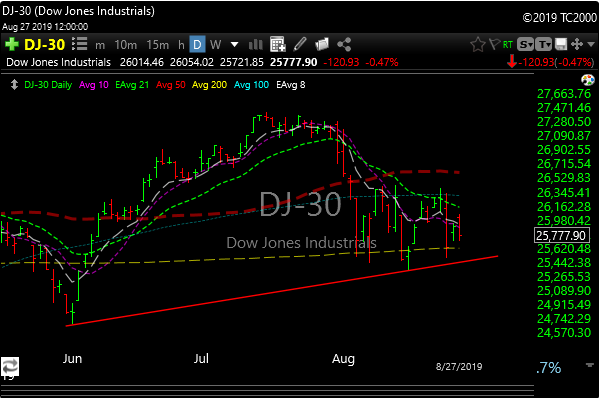

The Nazzy, SPX, and Dow are all kissing uptrend line support.

The NDX broke this uptrend line on Friday but managed to recover on Monday, but too close for comfort.

SPX-same story

DOW 30–

But what tops the ugly cake is the Russell. Not only is it right on key lateral support, but today it put in a big reversal that resulted in the mother of all bearish engulfing bars.

We’ve seen stocks, etf’s and indexes kiss these levels before and they bounce. I just want you to be aware because if they break lower on a closing basis we could see some more near term pain.

Today the 30-year Treasury closed below 2% for the first time ever.

We actually “closed” with an inverted yield curve today too. What does that mean? We’ll all be dead in exactly two years.

In other news, Bethany McLean was the gal that first discovered that things were a tad askew at Enron. She’s now on Musk and Solar City which will ultimately dovetail with Tesla. Here’s the link.

See you tomorrow.