Dow: -115.78…

Nasdaq: -37.59… S&P: -19.62…

I got that tap on the shoulder today. The one where you turn around and no one is there. I usually get that tap when I think the market is tired and it’s a signal for me to be more careful. The SPX has run 20%, so a pullback wouldn’t surprise me at any point here.

NFLX just reported a bad # after the close and the stock is getting bombed in aftermarket trading. Down about $45. That’s a big hit even for NFLX. As a result, it has the Nazzy (QQQ) down a couple of bucks in aftermarket trading.

I could make a good case for a pullback, but let’s see if the bulls don’t step up and buy this mini dip soon.

Energy (XLE) and the financials (XLF) are looking heavy again and as you know I’m bearish on XLF here.

Crude has turned lower ever since Pompeo said that Iran was willing to negotiate a few days ago. As a result, energy “stocks” have turned lower.

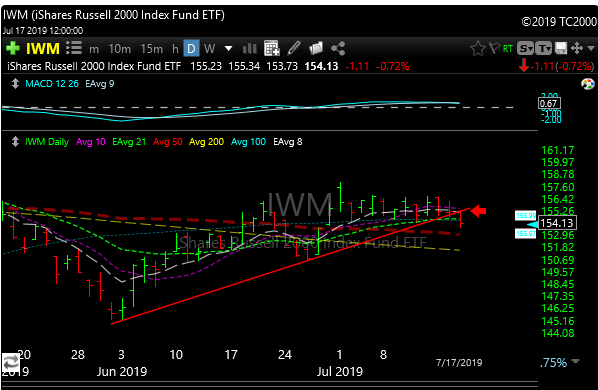

The Russell 2000 broke uptrend support today and has lagged this rally. Not many people know it but there is a big weighting of energy and regional banks in the Russell. Both are looking weak now.

I lightened up a little today just in case. There are still some great setups out there but some stuff is a bit extended so prices could come in a bit and drift.

I sold the balance of RVLV today. Stock acts heavy and that’s the kind of stock they will clip if they take this thing down 3-4%. I also lightened up on QD.

STNE was a new addition today. The stock had a tight flag and looked like a breakout. It did breakout and I even took a little off that one. I’m seeing alot of stocks failing on breakouts by reversing after the breakout, so I figured I would take some off.

Silver and gold just keep going.