Was also complicit in the kidnapping and torture of Jack Bower.

Dow: -473.39…

Nasdaq: -159.53… S&P: -48.42…

Today was another fun one down on the canyons of Wall Street. The Dow at one point was down as much as 648 points and it closed down 472.

It was a really tough news day too. Gaza fired 500 missiles into Israel. Republican lawmakers are kiboshing the infrastructure plan (only costs $2 trillion) so that hit steel and materials and other asset classes. North Korea was at it again, as it was firing off some short-range test projectiles, Trump Admin. is putting in place more significant sanctions on Iran AND…… the doozy of them all…….China and the USA hate each other again. Nothing is ever a done deal.

The buy-the-dip trade worked yesterday, but today it was largely non-existent. The lack of buying interest has forced out weak-handed holders of long positions put on yesterday, which exacerbated today’s losses.

There are valuation concerns, geopolitical concerns that the market has moved too far, too fast, and concerns the Fed isn’t going to be quick with an interest rate cut.

Other than that, things are just swell. I thought after yesterdays bullish reversal that we might see some follow through higher today, but after further review, the guys that move this market thought it was better to take some profits and lay in the weeds until all the craziness calms down, and there is a lot of craziness right now if you look past the headlines and what the jackasses on CNBC have been telling you.

Heres where we are at.

The SPX is just above the 50- day moving average. That’s a support area. so that will need to hold. We’ve lost about 65-70 points from last weeks highs, so no biggy yet.

NDX- Since it broke that beautiful uptrend last week (usually a warning sign), it has dropped about 200 points. Its 50-day moving average comes in about 200 points lower, so if the bears want to press their luck, that could be where this one lands and it will take SMH and IGV with it.

TNX– Treasuries (flight to safety) got bought aggressively today and yield fell as a result.

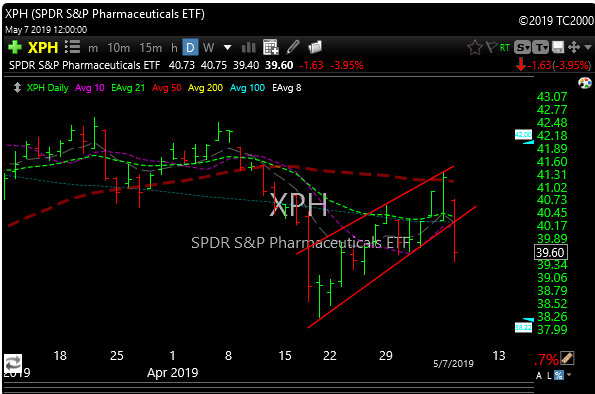

XLV– is back to its old ways. I told you in the Sunday video that the 50-day moving average could be a big fail spot, well it tagged it and then folded like a lawn chair and broke that bear flag. I’m seeing a lot of bear flags break lower.

For ten years of this bull market, the bears get a crumb thrown at them like today by the bulls, and to a short-lived degree, yesterday. But its usually just a crumb, they get it out of their system, sell some stuff and then things resume to the upside.

That can easily still happen here, but it depends on China now to a bigger degree. If that blows up, then the bears will feel empowered and we trade lower, maybe a lot lower, we’ll just have to see how it pans out.

I kicked the balance of ARRY today and another 1/3 QD as the latter is a Chinese stock. I also added LABD as a new long (short XBI) and I explained my reasoning in today’s email.

Regarding INTC, I think a lot of the sellers are out of the way, but if the market sees significantly more pressure just honor the stop, we can always revisit. CVS has already been beaten like a baby seal and the daily still looks fine, but the same goes for that one.

LYFT reported after the close and its up about a buck. UBER is on deck and WeWork filed their S-1 with the SEC to also go public. Silicon Valley players are pacing the conference room floors praying for their exits as the market gets into the nosebleed seats. Monetize or bust.

You have to wonder if its a top when Warren Buffett said last week that “he just started buying AMZN”. Also when you year that SoftBank, the worlds largest VC, may IPO their entire fund………..I’m sure it’s fine.

If anyone wants any info on my new service called The ShortSide, shoot me an email at…. [email protected]

Updated P&L here.

PS… For the new members, the P&L tab is on my website.