Dow: -48.49…

Nasdaq: +17.20… S&P: +2.94…

The S&P eked out a small gain today, extending a listless streak of trading at the start of a busy week for corporate earnings. A lot of really good news is already reflected in stock prices, and that’s why we’re struggling to move materially higher.

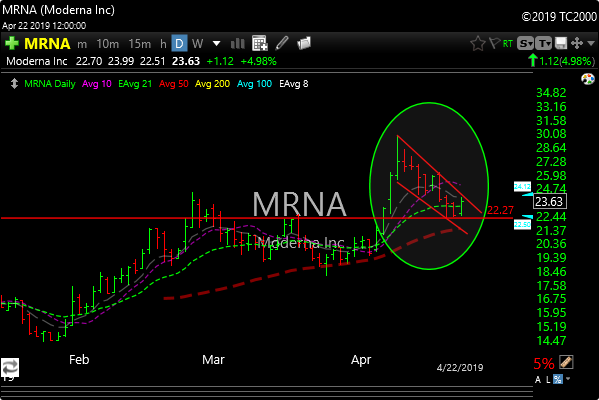

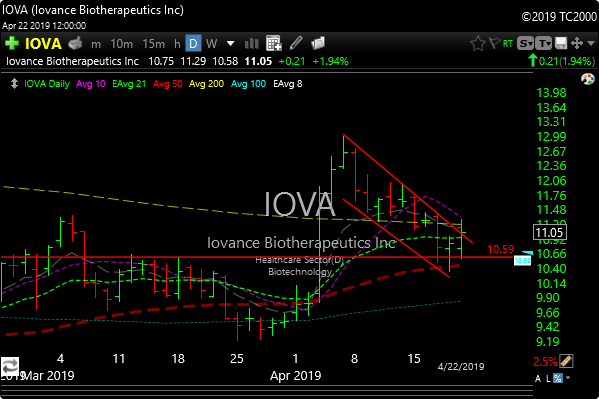

This action is boring, some stocks are consolidating sideways and some are setting up again after bullish breakouts, as they have come back down to retest those breakout areas.

Here are two examples of two stocks that had big breakouts and are now retesting that breakout area.

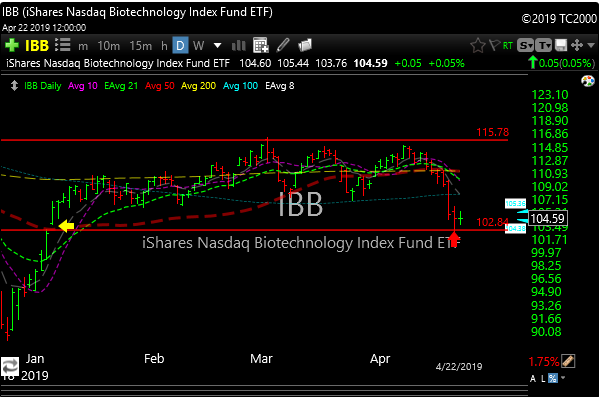

Biotech is still heavy but if the sector is close to bottoming then there will be a boatload of money to be made here.

Notice that IBB filled its early January gap on Friday (yellow arrow). That can signal the start of a reversal, we’ll have to see. It’s still below all of its key moving averages as is XBI, so it has a lot of work to do.

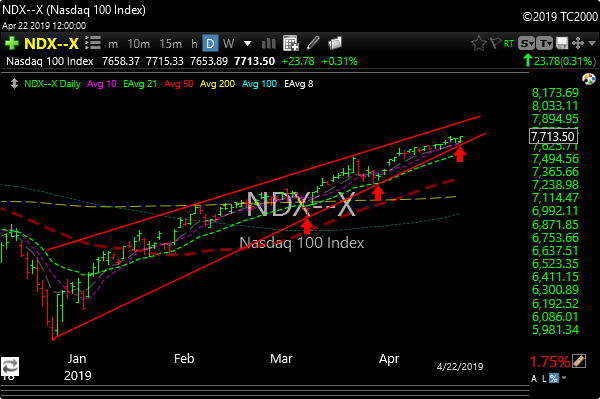

Right now the Nazzy chart is squeezing at the tippy top of a very tight bullish channel. My guess is that it wants to resolve and break higher, BUT I think it will depend on AAPL, FB, GOOGL, and AMZN first. The Nazzy will need some good earnings from the four horsemen to keep the party going. The market waits.