Dow: +14.51…

Nasdaq: -5.13… S&P: -2.35…

There was little conviction from buyers or sellers so stocks close little changed today.

Dwindling expectations for global economic growth contributed to a further decline in U.S. Treasury yields. Growth concerns were reinforced by another discouraging economic report from Germany. Germany’s Business Climate Index for March showed continued deterioration of the manufacturing sector.

Japan’s Nikkei was down 3% overnight. We talked about Germany and Japan last night. They have seen better days and it doesn’t look to be getting better anytime soon.

Today was good from the standpoint that they didn’t thrust the market down, after all, they did have the weekend to ponder and process whether or not we are at the gates of hell and full-blown Armageddon.

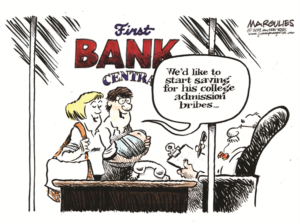

I read today that our favorite former Fed lawn gnome, Janet Yellen, opined that it might be a good idea for the Fed to actually buy stocks if the market ever goes crap-house again. She also added that maybe the Fed could cut rates, not raise them under that scenario.

I feel that I am living in an alternative universe sometimes. Central planning at its finest. I mean, this strategy worked so well for Europe right?

The markets and fund managers will get more clarity on the health of the global economy in the next few days, with fourth-quarter gross domestic product readings from the U.S., U.K., France, and Canada scheduled for release.

We’ve become accustomed to the market greeting dovish central bank turns with a bounce. Not now. The market wonders: What if the Fed is seeing something that we are not?

Let’s hope for the best but be prepared for the worst.