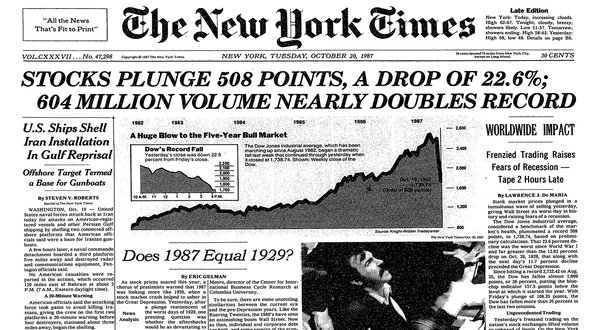

I believe today was the 30th anniversary of the infamous 1987 Black Monday stock market crash and it got me to thinking. Where the hell was I? Some of you rugrats were riding a big wheel when this amazing day occurred.

I was a mere pup sitting at my desk at Lehman Brothers and I learned a lot that day, I learned a lot about the market, market rules that I previously knew nothing about, and I learned a lot about people and human nature.

I learned that fear is a far far greater emotion than greed. Blood pressure levels move around more if you are going to lose 50% than make 50%. Pulse rates speed up more with the notion of losing all your money than doubling your money.

One of the guys at Lehman put in a huge order in his personal account that day. He meant to buy OEX puts to open (bearish trade), instead, by mistake, he sold OEX puts to open (bullish trade). The market imploded on him. A couple hours later some of my buddies raced to his apartment and found him drowning in his bathtub with a half-empty bottle of valium and a fifth of Jack. It was one of those nick of time deals. They saved him, but he was never the same. He lost everything.

What I really remember that day was the pricing of the British Petroleum IPO, at the time it was the largest IPO on record. Talk about bad timing. Goldman Sachs, Salomon Brothers, Morgan Stanley and Shearson Lehman Brothers as US underwriters were on the hook for 22% of the deal. The prized role of sole lead in Canada went to Wood Gundy, which went out of business as a result.

Privatizations were huge in the late 80’s. Everything in England and Europe was getting spun off to the public, NatWest Bank, BP and so many others. Bankers were printing money in their sleep doing these deals. Gobs and gobs of fees. I mean gobs. BP got done, the bankers put in floors on price and agreed to go on the hook if the world came to an end.

If you think algorithms are your enemy now, the use of new computerized trading was being broadly implemented back then and all the knots weren’t out of the rope yet-and it was not completely understood. When the selling started in Asia, computer algorithms saw this and automatically placed more sell orders. Cascading sell orders continued to drive prices down, which in turn caused more selling. It became a self-fulfilling prophecy.

This takes me to margin accounts. Many of my clients (and everyone else’s) used margin. It was a bull market, right? Margin calls were routine and clients never had a problem sending in money to meet a margin call. Back then you had five days to meet a margin call. This day was different. Accounts were getting so hammered, that not only did clients have margin calls, but many accounts bordered on negative equity.

The bosses at Lehman told us the five-day window didn’t apply and if you could not reach your client, then just sell them out. Brutal.

It was at that exact moment in time that I learned about the true goodness in people. It was a life lesson that I will never forget. I thought I was doomed and I thought I would be out of the business for losing people so much money. But not one person was angry at me. No one yelled at me. No one threatened me. Quite the opposite. Everyone, without exception, asked me how “I” was. They knew I was taking it from all sides and they knew it wasn’t my fault. It wasn’t anyone’s fault really.

The closest feeling to this that I ever had in my life was after I got blown out of the World Trade Center. The feeling was that we were all in this terrible mess together and people were nothing short of awesome.

People can impress you, too bad it usually takes a crisis for it to reveal itself.

I started in the business in 82. I was spoiled. Carter was out, Reagan was in and the market went up every day. 87 was a reality check.

About 20 years later we crashed again. Somehow I felt infinitely more prepared. This seemed different. It didn’t feel like a “one-off” like 87. We were so structurally screwed, unlike 87, and shit was all kinds of upside down. Unlike 87 when the selling climaxed quickly and we started the move up, 2008-2009 felt like it would take a lot longer to heal.

Fake loans, bad loans, if you have a pulse you got a loan. The financials and everything else collapsed. I fished with a guy who ran a 15-foot snook boat in southwest Florida that owned five waterfront properties off Ft. Meyers. No money down. The guy smelled like fish guts and scales, showered once a week. He could barely pay for gas for the boat, but he owned five properties. He had several teeth. He was flipping cribs every month. Making 15-20K at a time. Wash rinse repeat. I was impressed and amazed. Why wasn’t I in on this caper? I never played the real estate angle back then. I still don’t know if I was stupid or lucky.

Then we had the flash crash. The May 6, 2010, Flash Crash, also known as the Crash of 2:45 pm lasted for approximately 36 minutes. We lost about a trillion in market value in that short span of time on that one.

History may not repeat, but it often rhymes and we will get broadsided gain. As sure as there are death and taxes. Black swans are a bitch. You never see them coming.

***********************

Today’s market was fine, and biotech was starting to break out of its one-week consolidation in a very bullish fashion until Trump came out and barked out loud that he thought drug prices were too high……again. OK, we get it. Please stop killing my biotech breakouts.

I added HALO long and FINL as a short today.

NFLX beat and raised after the close and it popped a few points. It traded to 211 at one point.

BLUE and QURE were big winners today.

See you in the morning.