Stocks closed higher today, building on strong gains from yesterday. Tax reform is still in the air and rates are still low. As long as the clownish little men in Congress don’t wreck it, the market should stay in current trend.

I wanted to go over a couple of names that I have mentioned over the last couple of weeks.

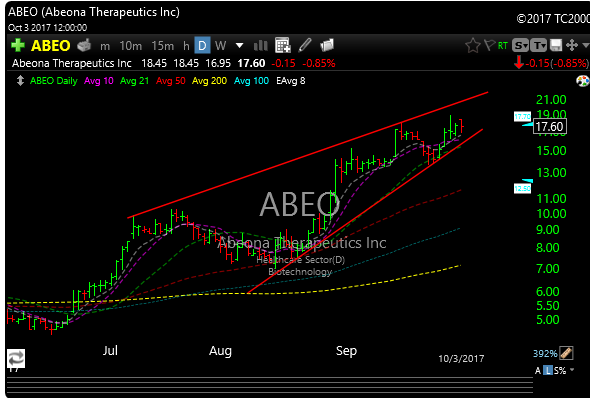

ABEO has been a beauty and continues to act well. The stock broke out around the 15 level where we originally started watching it, moved to the 18 level, pulled all the way back to 14, and over the last week has moved back up to 17.50. The stock is in a bullish up-channel as you can see in the chart below and may be ready to get going again. The targets are 20 and 21. Let’s see if we can’t pick this up on a better pullback, maybe around 16.50 level.

DLB is still in that beautiful bull flag and may be ready to go. Watch that 59 level.

XNCR this portfolio position has not jumped on the biotech bandwagon yet, but it is improving. Today it broke above some lateral resistance and managed to close above its 200-day moving average. Volume the last two days has been better than average.