I will be traveling tomorrow, so I won’t be in the chatroom, so the evening post will resume on Tuesday. I will be in the chat Tuesday.

It was a great week for the Russell 2000, and biotech made some more two-year highs and the XBI (biotech etf) is just about 4% from its old all-time high.

If you are ever wondering whether risk is on or not, take a look at the Russell (IWM) and biotech (XBI, IBB) both are great “tells” for risk appetite, and right now the joint is jumpin’.

Last week the IWM ripped through resistance and did so on excellent volume. See chart below.

Biotech (XBI), also broke above some lateral resistance that we have been watching for a while. Members have been killing it in this space and we currently hold a $25 profit in LABU and I ain’t selling yet. The XBI is just about 5 points away from all-time highs.

The FANG stocks (FB, AMZN, NFLX, GOOGL) traded soft about a week ago, but appear to be coming back nicely and the XLK (tech etf), is pushing to more new all-time highs.

Interest rates (TNX) are moving up. The 10-year note has gone from a yield of 2.03% to 2.32% in just three weeks.

As a result, the financials are moving higher. They love higher rates. Last month the XLF tagged levels not seen since 2007.

Energy (XLE) finally woke up and has caught a 10% rally since the lows of only five weeks ago. It’s now hitting resistance. we are out of energy for now.

Here are a couple of names to watch over the next couple of days.

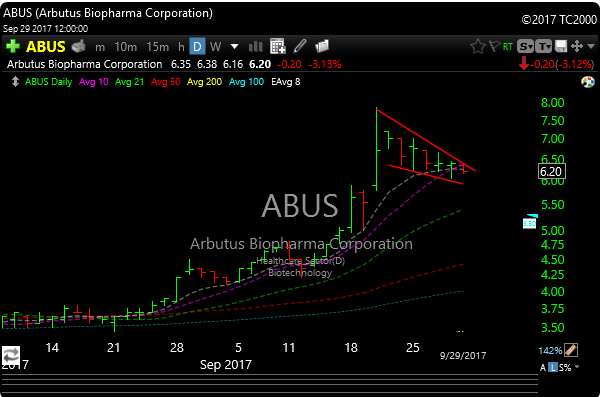

ABUS had a strong breakout on Sept 20 on massive volume, almost 15X its normal daily volume. Right now it’s consolidating this gain, as it forms a very bullish low volume flag/wedge. You don’t want to be holding this if goes below the 5.25-5.50 level, but it looks good for higher prices. Targets could be 7.75-8.75

SGEN-This one is on our P&L, but if you don’t own it, it’s still a buy. Great cup and handle pattern.

BMY– This could be a big winner if the wind blows the right way. Right now it’s flagging at resistance. I think 70-75 is doable if you can give this one some patience. That big gap down last year may start to get filled at some point. That gap fill is up around 74.