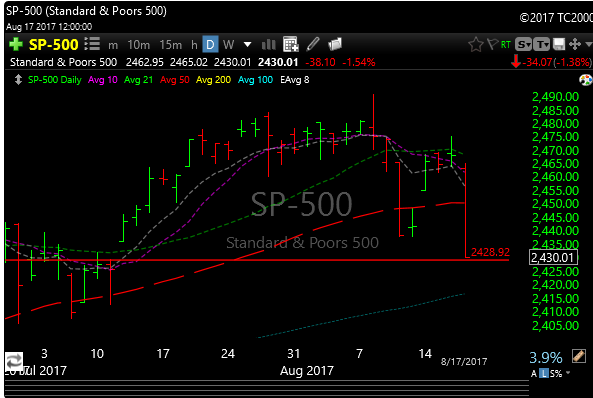

The market finally came in hard today. – 1.5% for the S&P, -1.2 for the Dow, a big -2% for the Nazzy and -1.8% for the Russell 2000.

The market gapped down today, moved lower from there, caught a little bounce in the pre lunch hour, then proceed to go lower all day.

The SPX broke minor support and went down to fill that July 12 gap.

The market always looks for a headline or a specific reason to rationalize a sell-off. Sometimes it just needed to happen.

It didn’t help that there was a terrorist attack in Barcelona that killed 12 people and injured 80. Slow volume summer trading can see magnified reactions to headlines and today was no different. I’m not minimizing that news, it’s just that low volume markets can be moved around a lot easier than normal volume markets. So tomorrow will be interesting, to say the least. It may be a situation where they take some more chips off into the weekend. Maybe not, we’ll just have to see.

Biotech is back to looking crappy again. I told you that the 50-day moving average on IBB and XBI was really important, yet after about four tries in four days, it failed every time to rise above it.

Biotech is good “tell” for whether risk is on or not, and right now it’s telling me that risk is off, at least for now.

It’s hard to pick tops, and you never know when you will get a bad headline day like today. Of course, you wish you were all net short yesterday, but that’s not how it works.

Our P&L has the least amount of long exposure in a while, partly because it’s summer, and partly because the market does look a bit tired, so I haven’t been adding too many names.

I’m sure the dip buyers are at the bar throwing a few back, figuring out their next steps.

See you in the morning.