Dow: -1.10…

Nasdaq: +40.80… S&P: +3.53…

The markets were flat today as technology recovered and energy gave everything back. XLE was down 2% and crude oil was down 4.2%. Crude got hit because Russia said they would oppose any more supply cuts. In addition, news that OPEC exports increased by 450,000 barrels per day month-over-month in June also acted as a bearish catalyst.

At this point, it seems there is nothing in sight that can get XLE out of this down channel. As you can see in the chart below it made another attempt on Monday to get above that 50-day moving average, but again it failed miserably and was rejected.

If crude remains challenged, SCO (short crude) could play long. Today it made a beautiful bounce of the 50 day moving average.

Semiconductors caught a bounce with the Nazzy today. I will watch SOXS closely tomorrow. SMH is still under most of its key moving averages, so the bulls will want a follow through day tomorrow.

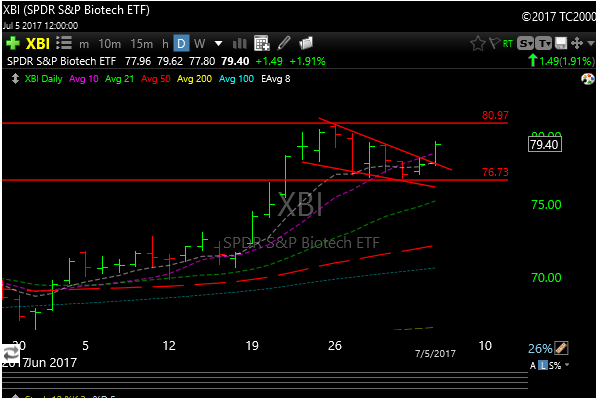

Some biotech names to watch:

ONCE, XON and CALA all look very bullish. More tomorrow. I think bio may be priming the pump to move higher again after this week long consolidation.