Dow: -98.89…

Nasdaq: -100.53… S&P: -19.69…

The numbnuts in Congress couldn’t agree on the healthcare bill, so it got kicked to the curb until after July 4. What a shocker. As a result, the market came in a bit, probably based on the uncertainty factor.

Technology continued lower and broke some of the levels that I spoke about in last night’s video.

Here is a look at the NDX (Nasdaq 100). Not good, as the FAANG stocks rolled over some more. See FB, AAPL, AMZN, NFLX & GOOGL. Not only did NDX break the 50-day moving average but is starting to break that uptrend line tat I spoke of.

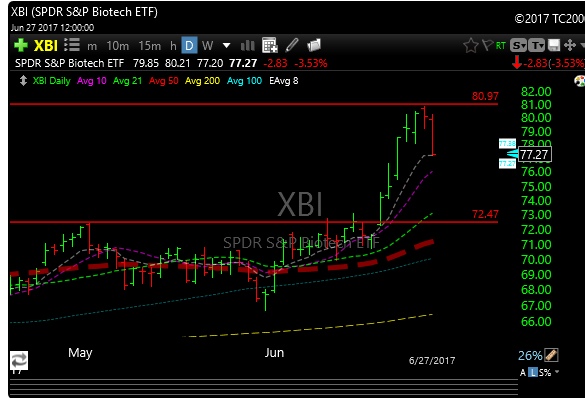

Stocks pulled back in bio land which was expected. XBI gave up 3.5% as profit taking set in. Whenever you see a pullback like this in this etf, its fair to say the the battle damage is more pronounced in individual stocks. As a result, there were a fair anount of 5-10% selloffs today.

There was a notable jump in long-term rates on today as sovereign bond markets came under selling pressure in the wake of a morning remark from ECB President Mario Draghi that the threat of deflation is gone. The yield on the 10-yr Treasury note (TNX)jumped six basis points to 2.20%, which contributed partly to the selling activity in richly-valued technology stocks and the underperformance of utilities (XLU) and staple (XLP).

The SPX broke the 21-day ma today. Support levels are 2413 and 2403.

I’ve been worrying about the semiconductors (SMH) for a while now, and today they snapped which helped weigh on tech.

I took the stop on GLYC as it took a quick 180 turn. It ran fro 13 to 14 back to 12.50. The volume was very light but better safe than sorry. Its a name I will probably re-enter, I just want to watch the action. If you are still long