Today the stock market gave back nearly all of yesterday’s climb to new record highs. Crude oil futures plagued the energy group, dropping as low as $42.95 per barrel, as concerns about excess supply, and a deteriorating technical picture, continued to weigh. Apparently, we have an oil glut……….who knew?

By the way, the FAANG stocks still look pretty uninspiring and have some battle damage to fix. (FB,AAPL,AMZN,NFLX,GOOGL)

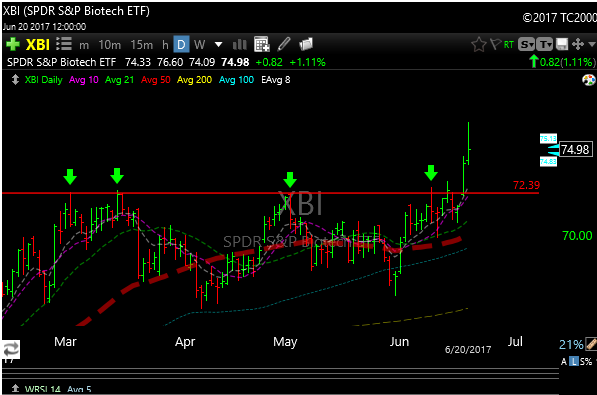

Biotech (XBI) added another 1% today after yesterday’s big breakout on almost double the volume, which is always a bullish sign.

I added one long and one short today. This is a great market, but to reiterate, for some reason, I have never seen better short setups, so like a bully in the schoolyard, I am trying tp pick on the weak kids.

One of those is ALGT. I shorted this one right near its 50-day moving average (red line and arrow). If it can break the bottom of that flag I can see 135 pretty quick. This represents a great risk/reward based on the stop. It also closed on the lows which is always a good sign.

P.S. If you are looking for a similar setup, check out SIG.

I added BMRN long today. It’s difficult right now to find individual biotech names that haven’t already run like a scalded monkey, but BMRN may be coming out of a little base. Targets 102-108

Some of the short ideas that I have talked about over the last couple of weeks have been stellar and have really been hit hard, but are hard to chase lower, but if you are looking for some idea flow on short side here you go: CENT, CTL, DDS, FIVE, FIZZ, KMX, COH, LAD, RL, STX

Some longs that look good are: AMPH, BCOR, BIVV,

P.S. Europe got spanked today, about 2.5- 3% across the board: EWU, EWI, EWG, EWP, EUFN, EWL, EWD, EWK