Dow: +144.71…

Nasdaq: +87.25… S&P: +20.31…

Wall Street kicked off the week on a positive note as the S&P bucked its recent sideways trend and advanced to a new record close. The Dow also settled at a fresh all-time high while the tech-heavy Nasdaq exhibited relative strength as technology and biotechnology stocks outperformed. The three major averages finished today’s session at their best marks of the day.

The health care sector (+1.1%) XLV finished higher and biotech names were among the sector’s strongest components on Monday, advancing IBB higher by 2.4%, with Biogen ( +8.80) leading the charge. BIIB jumped 3.5% after the company was upgraded to ‘Neutral’ from ‘Sell’ at UBS.

It’s amazing how a move to “neutral”, not “buy” can pop a stock 3.5% on volume. This stock has been very oversold, so it doesn’t take much to get the shorts to cover, By the way, BIIB is looking pretty good here, the setup isn’t bad at all. I’d like to see it close above the 50-day moving average though before I get too excited.

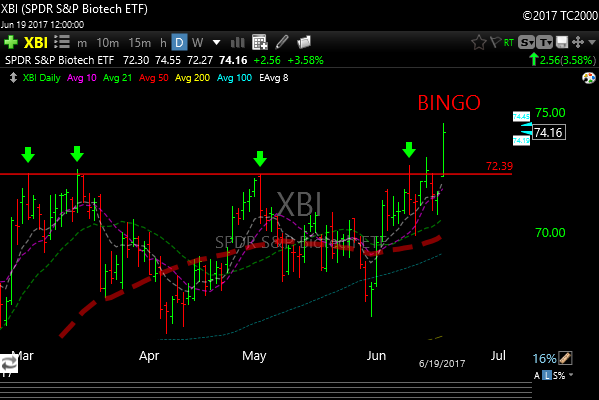

XBI, the other biotech etf, popped 3.6%. XBI and IBB usually trade in tandem, but XBI outpaced IBB today because CLVS was a holding in the etf and it ripped 46%. IBB did not have exposure to CLVS.

I’ve talked about all the failed breakouts with XBI for months now, but it looks like today may have been the real deal as it broke above and held above resistance.

I took some partials today on some positions: LABU +18.5%, ICPT +11.7% and KITE +6.8% On the short side, I covered a little SLCA +6.1%.

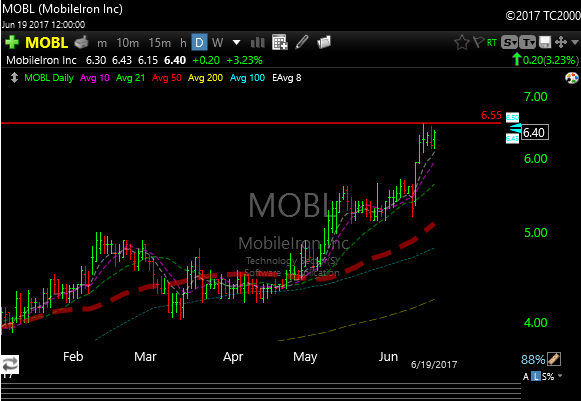

URI did not trigger today but I added MOBL to the P&L as a new long.

MOBL is flagging at a two-year breakout spot and volume is picking up. If it can get above the 6.55 area with some volume, I have targets of 7 & 8.

MOBL daily chart

MOBL Weekly Chart (great base)

See you in the morning.