The derelicts in Washington tried to muck things up again for the market last week. Just as they fail to be effective Senators and Congressmen, they failed at screwing the market, although things did get weird after lunch on Friday. I guess a bell rang and they realized that $GOOGL and $AMZN have been up every day since the Age of Pericles so they hit bids.

We could be seeing the start of a rotation change, although I never put much credence in a one-day event. I am not saying by any stretch the market will pullback, but money may start to move around, leaving one sector for another.

Metals & Mining

We saw some interesting action the last couple of days that could prove me right. First of all, the metals and miners ($XME)had a big move on Thursday and is poking at some key lateral resistance. Definitely worth watching though, this group can trade as hot as biotech when it gets going.

Energy

Energy has been wrecked. Oil prices are down and no matter how much the Saudis and OPEC puke their rhetoric, it’s not really making a difference. The XLE is down about 20% from the December highs, but it caught a bounce on Friday off some key lateral support that goes all the way back to this time last summer.

We saw a similar bounce in XLE on Tuesday only to give it back Wednesday and then lower on Thursday. Friday it bounced about 2.5%, but I won’t touch it unless we get a really solid follow through day on Monday. What does solid mean? Big volume.

What’s with tech? The $QQQ was massacred on Friday with volume not seen since August 2015. Was it a one off? Algos just blowing off some steam? If this is sustained, then money will find another home, maybe banks, bio or energy. I always wait for the action the second day, NOT the first to sort these things out.

SEMICONDUCTORS- $SMH

Not sure, but it doesn’t help the Nasdaq when the semiconductors puffed into pixie dust, down almost 4% in a massive bearish engulfing bar.

The volume was massive too, the positive takeaway on the semis is that in the last year, every time $SMH experienced volume like that, it shook it off and went on to make more new highs, so who knows what happened Friday. Maybe a top, but maybe not.

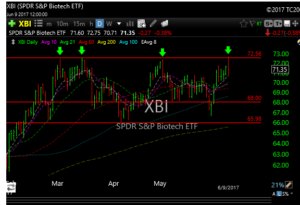

Biotech ($XBI) really does look like it wants to make some noise and move higher, but this is the fourth time its been at this spot this year and every time it failed, so next week should be telling I would think.

Financials

Banks love lower regulation and higher rates. They got help on the former last week but rates continue to stay fairly stagnant. The action in $XLF was impressive last Thursday and Friday and the volume was good, so higher from here most likely.

See you next week and good trading.

You can become a member here. If you would like to view my three-year performance, email me at [email protected]