The worm hasn’t turned on the market yet. Granted some sectors are showing bipolar behavior, but sectors always do their own thing anyway.

Its always good to be defensive though when it the market keeps going sideways for too long. Consolidation can be good, but you just don’t know if its the prelude to what could be a quick 5-7% correction.

With that said, I tightened up some stops today and took a little off the table. Not much at all….a little.

Today I added 3 shorts …..GRMN, MIK and a long in JDST. (JDST is the etf that gets you “short” the junior miners) I didn’t have time to elaborate today in the email because things were fluid, but the miners are seeing some serious headwinds as higher rate chatter gains traction.

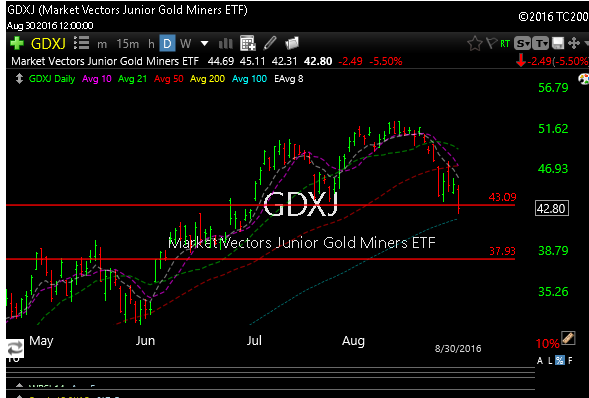

As you can see below, both GDX and GDXJ (junior miners) are starting to break down hard. Charts below.

GDX broke the uptrend (red line), two weeks ago and has seen nary an uptick.

GDXJ -I think the junior miners could be even more at risk

In both cases there is a long way down if this action continues, especially if we get a hot jobs # later in the week.

Please note that in my email alert I warned that this etf is 3X leveraged and is not for the faint of heart, so smaller positions and wider stops is recommended.

If you look at the chart for JDST, it looks pretty good from a long side perspective. So does DUST which gets you short the GDX (the bigger miners). Targets are 36 then 43 for JDST.

Regarding the GRMN short. Its breaking down and could be heading for that gap fill at 46.50…red line.

Regarding the MIK short. Technicals are breaking down and I see 22 then 20

As always please check the P&L tab on the blog so you can stay updated.

See you in the morning.