Navy Seal hopes dashed

Dow: +107.59…

Nasdaq: +13.41… S&P: +11.34…

- Russell 2000 +9.5% YTD

- S&P 500 +6.7% YTD

- Dow Jones +6.2% YTD

- Nasdaq Composite +4.5% YTD

Today was the lightest volume day of the year.

The market ended its first session of the week on a high note, as markets rallied back from Friday’s Fed-driven mixed and volatile session. While Wall Street rallied to kick off the week, volume and news flow was noticeably light with some traders already having stepped away from the desk in anticipation of the Labor Day holiday. Commodities were fairly quiet in today’s session with gold gaining $0.40, while crude oil pulled back, dropping almost 1.5%. A number of headlines over the weekend involving several OPEC members contributed to today’s selloff.

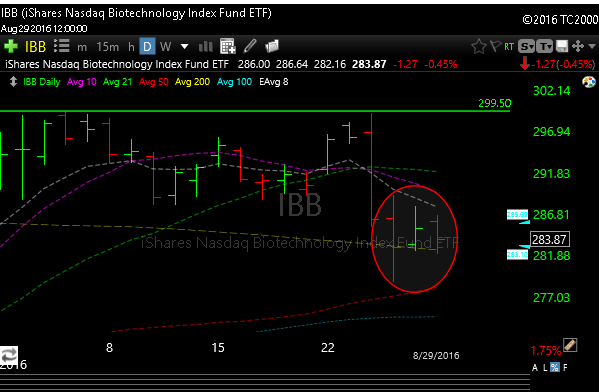

Biotechnology underperformed in the health care sector (+0.3%), evidenced by the 0.5% loss in the Biotechnology ETF (IBB ). The group remains pressured following recent calls for the industry to adjust its drug-pricing practices. On that note, Mylan Labs ended higher by 0.4% as investors mulled over the company’s decision to produce a generic version of its EpiPen device.

IBB is currently sporting a bear flag every since the Hillary nuke went off last week, but the positive takeaway is that it has still managed to hold the 200 day moving average for the last three days. As I get older I try to look for the good in things, stocks and life, so i’ll take it.

See you in the morning.