This will be a fairly short post as I hide in the corner and stay away from things as we approach the insanity of the Brexit vote on Thursday. I don’t even like typing the word to be honest. Nothing will really be actionable until Friday, as that is when all information, good or bad, will be processed and disseminated.

Brexit is serious, but it’s also a sideshow which in my opinion is doing a great job of of covering up Europe’s deeper issues. Negative rates, unprofitable banks, off the chart unemployment in every country, and the onslaught of migrants, 90% of whom go straight to the welfare state.

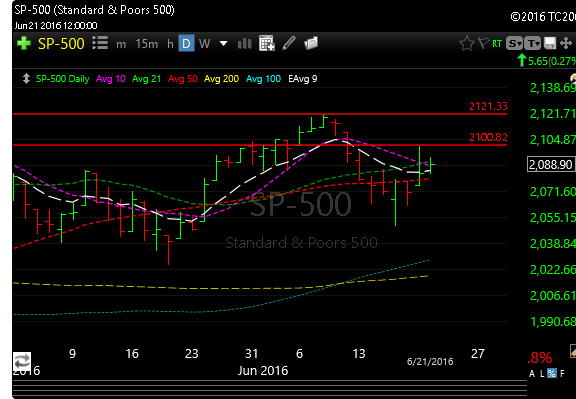

Worry certainly exists, and you can tell by how the market has been trading the last few weeks. Just last week on June 13, the CBOE Volatility Index (THE VIX) closed at 20.97, which marked its highest level since late February. Currently, the index is up 2.5% to 18.82.

The VIX is based on prices of S&P 500 options that investors tend to buy when they’re fearful of stock declines, giving the index its nickname, the fear gauge. Technically, the VIX measures implied volatility, or investors’ expectations for stock swings over the next 30 days.

While the VIX is on the rise, the SPX hasn’t posted a swing of at least 1% since May 24. In any event, the VIX should have a fairly massive move either way come Friday.

I have a list of about ten solid long setups and about ten solid looking short setups depending on which way we should go over the next several days and early next week.