“The only function of economic forecasting is to make astrology look respectable.”

John Kenneth Galbraith

This isnt going to be a “Lee Harvey Oswald didn’t act alone” rant, nor am I saying that the Bilderberg Group or the Illuminati really run the global economy…….but WTF is up withe the fed????

When unemployment was around 9%, Yellen promised the beginning of a series of interest rate increases when unemployment hit 6%. Well we are at 4.7%. Hell, by old standards that’s almost “full employment” (check your old Eco 101 textbooks).

I think Yellen knows we’re on the cusp of a disaster and she is absolutely terrified of a strong dollar, and she will do anything and everything to keep it down. It’s in her financial engineer’s DNA.

Europe is doomed even without a Brexit and you know the IMF’s LeGarde (and probably Draghi) have been begging her to take a dovish tone so as not to upset the global economy even further.

The most affected institutions include some of Europe’s biggest hitters, from Deutsche Bank and Credit Suisse, both of which hit new record lows yesterday, to HSBC, which hit a new five-year trough this week, and Santander, which is on the verge of breaking through its lowest point since the 1990s.

If Europe’s biggest banks are in trouble, it’s safe to say that Europe’s financial system is too.

There is no better example of this than Europe’s fourth biggest economy, Italy, whose banking sector is once again looking extremely fragile. The shares of the country’s biggest bank (and global systemically important institution), Unicredit, are down more than 20% this month, 57% since January, and 64% over the last year. The stock of Banco Populare, Italy’s fifth biggest bank, has lost 35% of its value this month alone and a staggering 75% since the beginning of this year. The fourth biggest institution, the perpetually failing Banca Monte dei Paschi di Siena whose loss-making derivatives bets were made under Mario Draghi’s watch as Bank of Italy’s governor, is in the same leaky boat. Amazing that he’s now in charge of the ECB. Amazing.

This is why the ECB is once again talking about doing “whatever it takes,” this time in the event of a Brexit.

Anyway, Yellen started speaking around 2:15 PM and stocks were hanging in there. At around 3:45 the sellers aggressively showed up. It was weird action as the sellers waited to the end.

The VIX ripped about 7% in 15 minutes.

The SPX lost 10 handles in about 15 minutes

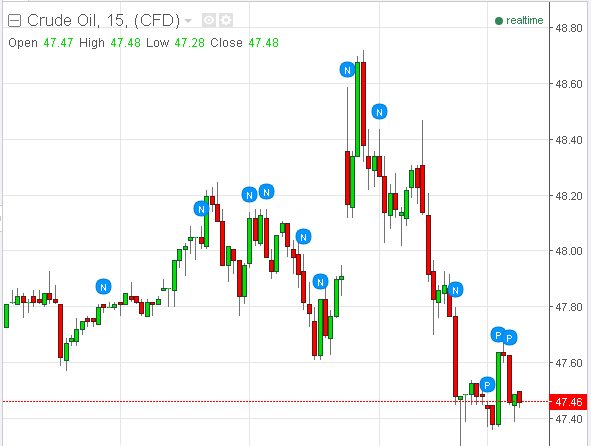

Oil also started selling off aggressively late in the day.

Bottom line, it was a weak close and that’s not technically good, but right now futures are slightly green, so no follow through for now.

….but its time to refi……again…… as the 10 year yield broke 1.60%

Of course commodities rallied today.

See you in the morning.