Dow -19.86 at 17985.19, Nasdaq -16.03 at 4958.62, S&P-3.64 at 2115.48

The market snapped its three-day winning streak, but the decline was modest in scope as the S&P lost just 0.2%. Equity indices faced some early selling pressure as the markets were reminded about the presence of global growth concerns after China reported a 0.5% month-over-month decline in CPI.

Markets in China and Hong Kong could not respond to the weak inflation data due to holiday closures, but the commodity market appeared to take notice as copper and crude oil retreated. Copper futures fell to a four-month low, dropping 1.2%.

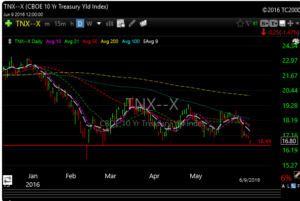

Recently, Treasury yields have been predominantly dragged down by the drop in government-bond yields around the globe, rather than by demand for haven assets. Yields in Germany, the U.K. and Switzerland hit record lows this week

The 10 year is testing February lows on yield.

Oil was down almost 2% but held the 50 level.

Biotech was heavy today, so I didn’t make any moves on ICPT or NBIX until that etf firms up.

Technology has been going sideways basically for a couple of weeks. XLK is actually approaching a quadruple top, so it will be fascinating to see what she does if it can creep up a little more to that level.

Steel and materials gave back some gains today too. Financials were weak again as rates continue to drift lower. Of course gold and miners were higher.

Its a tough market right now. Shorts creep higher and I’m seeing more and more false breakouts to the upside (see BUFF). So its quirky right now and the bulls and bears are ready to pull the trigger aggressively I think.

My guess is that the downside trigger will be Europe. Although Draghi announced that he was buying some bonds, normally bullish for this market, he also said that Europe has structural problems that QE alone cant fix. This took a shine off any optimism and European banks sold off on his comments.

If this thinking takes root, it could set off some further alarms on the other side of the pond and ripple to our markets. We’ll just have to wait and see.

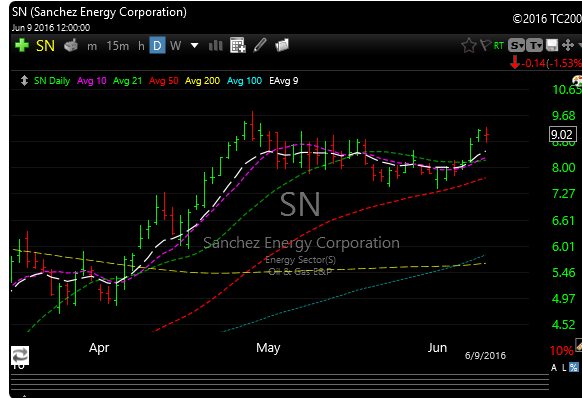

I added SN as a new long today.

See you guys in the morning.