The S&P 500 index closed at 2,105.26 on Thursday, topping the psychological 2,100 level for the first time since April 20.

That round number has served as a resistance level for some time. During each of the last two days, the index crossed 2,100 on an intraday basis, before closing lower.

Since August, it has crossed 2,100 during trading hours 20 times, but only closed above that threshold eight of those times. The S&P 500 is still below its all-time closing high of 2,130.82 in May 2015. But if one includes reinvested dividends, the S&P 500 Total Return index has already set new all-time highs over the past week.

Who knew? Sure doesn’t feel like it.

Institutional Investor interviewed ten top hedge fund managers recently. The question was,…. what is your trading strategy regarding the next President of the U.S. ?

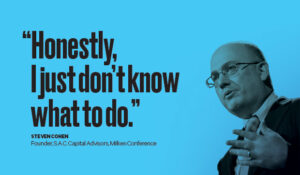

Here is what Steve Cohen (one of the best that ever lived), had to say.

I think what Cohen said is a microcosm of the market right now. Many are watching to see who blinks first. Today’s action wasn’t impressive. Maybe when/if we get closer to those all time highs, volume and conviction will pick up. Right now we limp.

See you in the morning.