- Nasdaq Composite -5.9% YTD

- Russell 2000 -3.3% YTD

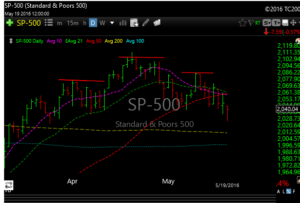

- S&P 500 -0.2% YTD

- Dow Jones +0.1% YTD

Equities began their day lower as hawkish commentary from April’s FOMC minutes pressured global markets. The minutes indicated that a June rate hike remains in the realm of possibilities, so long as incoming data remains consistent with a projected pick-up in economic activity for the second quarter. As a result, markets assumed a risk off posture while strength in the dollar weighed on dollar-denominated commodities.

The Dow fell for a third straight session and the S&P erased its gains for the year, underscoring how the prospect of higher interest rates has unsettled investors this week.

The Dow fell 91.22 points, the S&P 500 lost 7.59 points and the Nasdaq lost 26.59 points, or 0.6%.

The financials which bounced higher yesterday on the prospect of higher rates, gave back lost 1.0% today.

U.S. crude-oil prices fell 0.1% to $48.16 a barrel.

The dollar was down just slightly.

The SPX has been trading below its 50 day moving average for a few days now,but it did manage to hold the technically important 2040 level today.

I had a few questions on RACE. I had trigger for a short sale at 43. The next day it opened below the trigger price so I never really triggered it, however if you took it anyway, it looks terrific and lower, just make sure you adjust your stops accordingly.

Its still a very tricky market out there folks and the bears for now seem to have the edge. Yellen’s hawkish tone caught the market by surprise a little yesterday and it just depends how bad they want to punish stocks right now.

European stocks still look heavy and China continues to act poorly, so its important to look at everything right now.

China

Europe

See you in the morning.