Stocks rose and the yield on the 10-year Treasury note fell for the first time in eight days after the Federal Reserve suggested it wasn’t in a rush to raise interest rates.

The market carved out session lows mid-morning as it weighed the latest data from the Department of Energy. The weekly inventory report showed a smaller-than-expected build in crude inventories (1.99 million barrels; est. 2.36 million), but a larger-than-expected build in gasoline stockpiles.

Crude initially tumbled following the #, but reversed off its low and ended the day at 45.21. The dollar traded pretty flat. I took the stop on SCO which probably means oil will dump tomorrow.

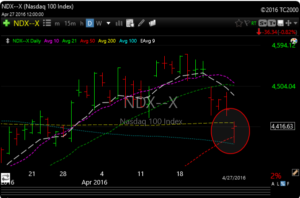

The Dow Jones rose 51.23 points, while the S&P gained 3.45 points, or 0.2%, to 2095.15. The Nasdaq continues to act poorly, but after a horrible morning of selling in the index, it did manage to take back the 50 & 200 day moving average.

See you in the morning.