$30 oil ‘within days’ — what analysts see for the market after Doha talks fail

The above snippet of genius was on the cover of MarketWatch at about 5:39 am this morning. Crude oil managed to close about flat. Maybe the “analysts” will still be right, but in my opinion the oil bears had a chance to knock the stuffing out of crude oil today, but they didn’t.

Here is today’s 15 minute crude chart…moved higher, not lower all day.

I think what may have saved oil’s ass to a degree today was the fact that Kuwait, in the midst of a worker’s strike, saw production decline to about 1 million barrels a day from 3 billion a day. Time will tell how this all plays out, but I think your trading range on oil will be 37-43.

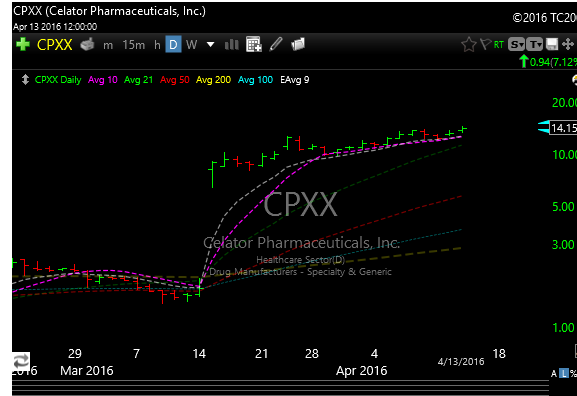

Today’s cause of anxiety and stress (there’s always one), was CPXX, one of our longs. As you can see in the chart below, the stock was pushing hard to new all time highs until about 10 AM or so. At that point it sold off $3 on a report that a clinical trial had been cancelled (not good right?). The stock then stopped trading, reopened then stopped trading again as information was processed and disseminated.

Long story short, this was evidently old news, the stock reopened for trading and it proceeded to go higher and closed at 16.30.

In the spirit of risk management I sold some in two pieces. I’d rather post less of a gain then be the victim of a catastrophe. If you missed my alerts and are still long, well the worst seems to have passed and I would hold, but make sure you have a stop. My first target was 17 anyway, so its close.

I also moved up the entry today on LXU and made an entry at the 13.55 level. My target is the 15.50 area.

I also sold the rest of AAPL today, what can I say? It looks pathetic again.

Here are couple of stocks that are setting up nicely for you to put on your watch list.

NBIX

ADXS

FAST– Looks like a short. Targets are 43 then 41