Rising oil prices buoyed stocks Friday, but major U.S. indexes still ended a rocky week in the red.

Stocks around the globe declined this week, as worries resurfaced about the ability of central bankers to lift a sluggish global economy after years of easy monetary policy. It marks the second week of declines in three weeks for major U.S. stock indexes.

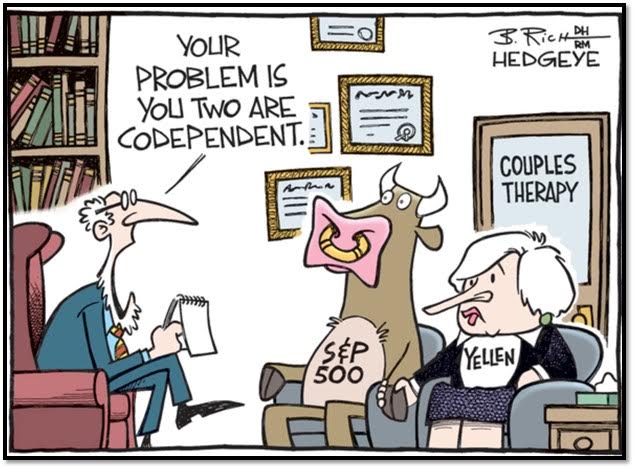

Two weeks ago, the stock market was propelled to its sixth gain in seven weeks by dovish remarks from Fed Chair Janet Yellen. However, equities were unable to build on their recent strength, ending the past week on a lower note. The S&P lost 1.3%, narrowing its 2016 gain to 0.1%, while the Nasdaq also lost 1.3% for the week to extend its 2016 decline to 3.1%.

The market didnt receive any market-moving economic data over the past week, but with the market having reclaimed its entire slide from January on the back of increasing dovishness from global central banks, market participants began asking what that dovish tilt implies about global economic growth prospects. One did not have to look far for signs of slowing growth as the Atlanta Fed GDPNow model for the first quarter was revised down to 0.1% on Friday. Basically we suck.

We will get a glimpse next week as several notable companies, including major financial firms, are set to release first-quarter earnings.

As of March 31, first-quarter earnings for S&P 500 companies are forecast to contract 8.5% from the same period last year, which would mark a fourth consecutive quarterly decline, according to FactSet. Analysts expect quarterly earnings to rise in the second half of the year.

Next week should be a hoot.

Have a great weekend, get some rest and I’ll have the market video out at the tail end of the weekend.

Joe