May you have the hindsight to know where you’ve been, the foresight to know where you are going, and the insight to know when you have gone too far. – Irish Proverb

They say everyone is Irish on St. Patrick’s Day, but I still expect full attendance tomorrow. If it wasn’t for beer we would have taken over the world.

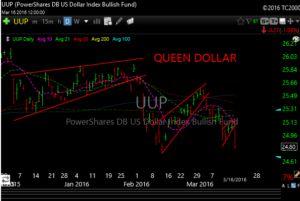

Yellen waxed dovishly today as she said she sees only (maybe) two more rate hikes this year, she took a breath and left open a move to a zero fed funds rate though if things got really bad, ie…a black swan, recession….whatever.

The takeaway is that this is probably good for gold, silver, metals and mining, utilities (very stretched) and those commercial real estate reits (IYR), also stretched like Gumby. Bond equivalents so to speak, in the case of the two latter names.

Housing will still get to breath for a while longer with low rates, but the banks wanted to hear a much more hawkish tone. I mean most of the folks have already refinanced and banks cant make a decent spread on their money with rates this low. Just think how the European banks feel, that problem will come back home to roost soon enough by the way.

Back in 2014 if Yellen came out this dovish the DOW would have popped 300-400 points, so you have to wonder if the fed’s antics aren’t a bit diluted at this point. The market however processed the info and ended up moving higher into the close. How could it not?

Crude had a decent day on talk of an OPEC sit down in Qatar and it didn’t hurt that the dollar got crushed yet again.

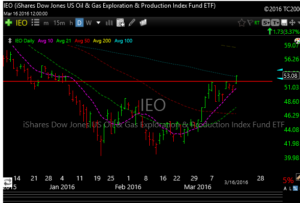

Crude may be approaching resistance near the 40 range but “energy stocks” act well here. Look at the charts of XLE & OIH. Also, another group within that sector, oil and gas exploration (IEO) looks very good and could be breaking out. An etf that tracks this sector is GUSH, this is a leveraged etf that tracks IEO and it it looks good so I added it as a long today.

Here is IEO

Here is GUSH (as with all leveraged etf’s, please use smaller size)

As you know, because VRX has upset the apple cart in bio and pharma, an opportunity may be brewing in XPH which is the etf that a lot of the generic and specialty pharma stocks call home. VRX is a mess, but I do think a lot of the pain in these names is probably overdone to a large extent. Also it may be putting in a triple bottom on the daily chart. I will be watching this closely, but it could be a phenomenal 3-6 month hold down here with minimal risk. This group is no to be confused with IBB.

After this consolidation, more longs and shorts are setting up again. Stay tuned.

See you in the morning.