The market has been going sideways the last several days on light volume, mainly because its working off overbought conditions and the fed is up on Thursday. Trading has been calm in recent sessions, a shift compared with the sharp swings that were common earlier this year. The S&P has moved less than 1% in 10 of the last 13 trading days, the longest such stretch in about four months. Yesterday was the lowest volume day of the year and today was the second.

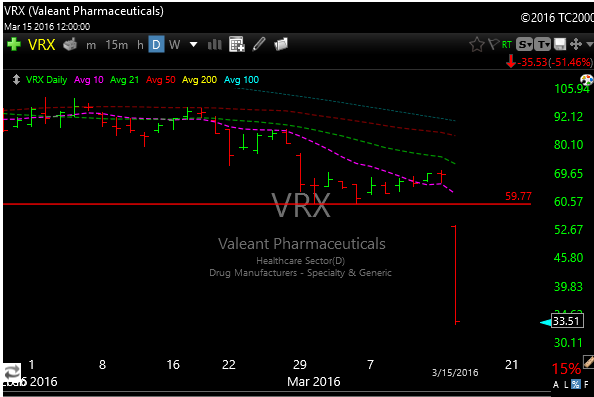

In the meantime, biotech is getting thrashed. The IBB was down almost 4% today an is breaking support. This flight from risk in the sector has been building of late, but it was no doubt helped along by the disaster that is VRX. The stock has been a mess this year, and today it dropped 51% and closed near the lows. This didn’t help confidence in the sector today and I saw many biotechs down 10,20 even 30% just today.

Energy stayed firm today and OIH and XLE maintain bullish patterns even though oil was down.

AAPL triggered today and looks good. Futures are flat right now.

See you in the morning.