I was going to do video tonight to analyze all the etf’s and indexes, but today was the lowest volume day of the year and not a lot happened. As I mentioned yesterday, before today, 4 of the last 5 trading days have seen declining volume. This isn’t necessarily a bearish thing, the market has rallied hard and its taking a rest.

Draghi and Europe did there thing last week, so this week we wait not only for the fed, but also the Bank of Japan, the Swiss National Bank and the Bank of England to do their own version of some quick pickin’ and fun strummin’ on the guitar.

HIMX looks good and is breaking out. Energy rested today as crude sold off. Iran continues to avoid playing nicely in the sandbox with the other OPEC kids, and wont even hear of the idea of freeze. Also the Prince in Kuwait said today that the only thing he’s heard about a get together with OPEC is via the media and said he never got an invitation. Reuters is fast becoming the National Enquirer and runs these rumors incessantly. Shame on them.

Be careful chasing some of these XME (metals and mining names). Stocks like X have doubled in two weeks. There are so many other exhibiting the same behavior and you dont wont to be the last guy that leaves the dance with the fat girl with back acne.

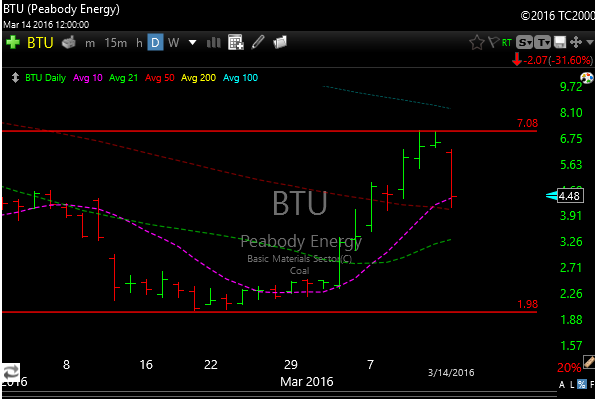

As an example, BTU has traded from 2 to 7 in abut two weeks. The chart still looked great at 7 (needed to consolidate), then someone hit it with a can of whoop-ass today and it fell 30%. So be careful, as I said, fast money is rarely sticky money and when they hit the bid they usually mean it.

Gold (GLD), silver (SLV) and the miners (GDX) all gave back today. The GDX gave back the most, down about 4.3%. Its still hard to tell if they have topped, or just letting some air out before another push higher. I still thnk silver will eventually play.

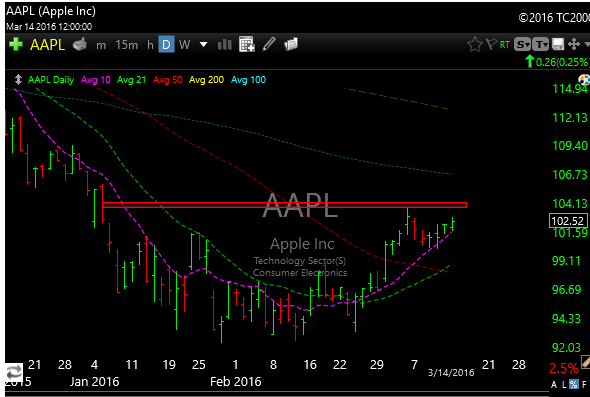

I am adding AAPL as a long tonight through the 103.75 level. Very nice base setting up.