I’m not a market timer, I will leave that to guys like Tom DeMark and Tom McClellan. Its the hardest thing to do, but they have their propriety toolkit and I respect that. Based on market conditions on Friday and Monday (sell off from highs of day and closing on lows of day), I was fairly convinced things would start breaking lower. The technicals even backed that up.

Then today happened, and what a rally it was. I’m still fairly convinced that we may be in the very beginning stages of a new bear market, but bear market rallies are known to be vicious and unforgiving and I didn’t plan on one today.

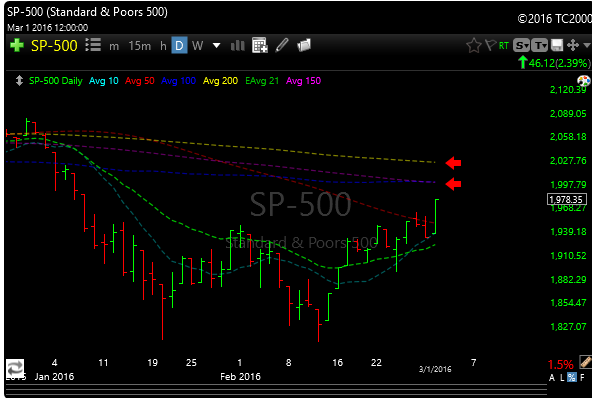

The key for the bulls now will be a follow through day tomorrow. The SPX has now broken above lateral resistance and the 50 day moving averages, all good for the bulls. This is what they were waiting for.

The Nasdaq was the best performer today as it rose over 3%.. The much maligned FANG stocks all woke up and ripped higher. Risk off sectors like gold and utilities sold off, as did treasuries.

By some accounts we are now overbought , BUT (insert cliche), we can stay overbought.

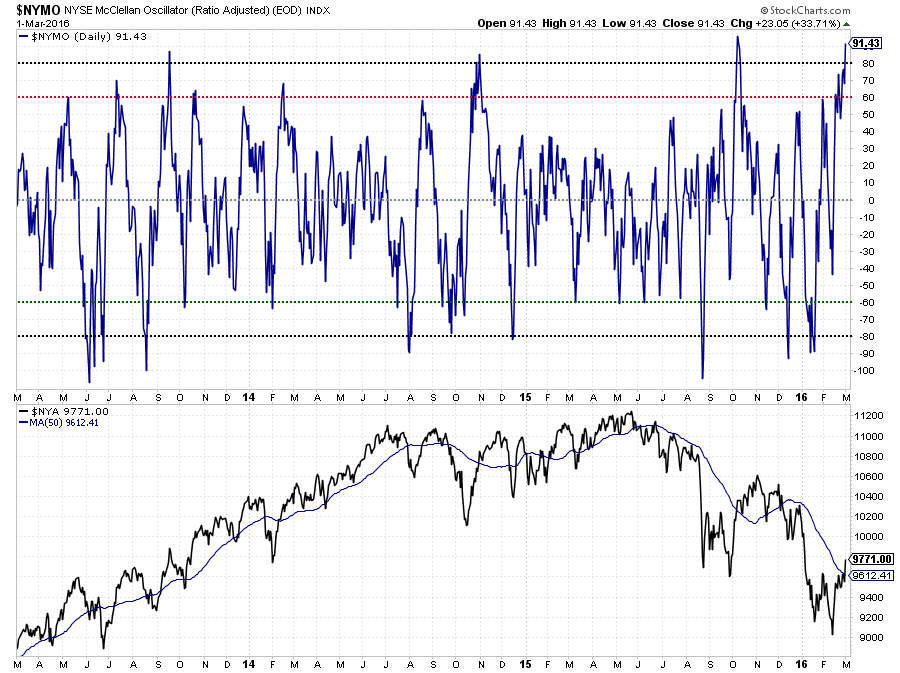

I posted the chart above of the NYSE McClellan Oscillator, I usually post the other one, but as you can see it registered a close at 91 today. If you go back several years on that chart, you can see what happened next. Misery ensued. Is this time different? Will it break higher this time?

In the chart below, I highlighted with red arrows where the next couple of targets could be should the rally continue. The 200 day (yellow line-2025) and the 100/150 day (2000) moving average.

Unfortunately we caught some stops today due to the rally. This happens and we’ll return to profits shortly. We always do.

EDZ opened below stop, when that happens I usually hold on for a bounce back so I will keep you posted. Have a great night and i’ll see you in the morning.