Global stocks rekindled their rally on Monday, spurred by rising commodities prices.

Twenty-nine of the 30 Dow components rose, from battered financial and technology stocks to better-performing consumer companies like Coca-Cola, pushing the index into positive territory for the month.

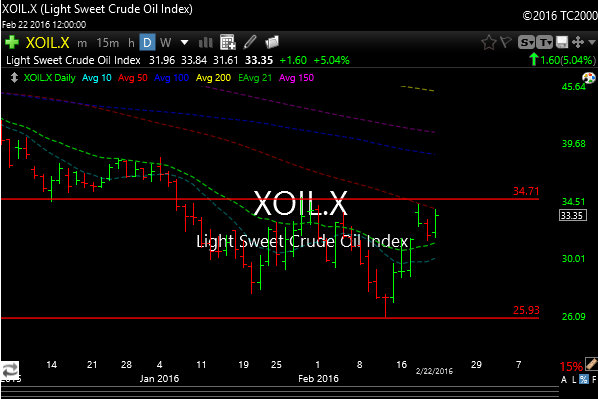

Oil’s bounce started about seven days ago and if you look at the charts, that is also when the markets started their bounce higher. Lets face it, this market was in peril because crude oil was in peril. Its still linked and it hasn’t disconnected yet.

The question is what happens now? Crude has bounced $7 off its lows and is hitting some resistance here as it approaches the 35 level. Nothing has really changed. There was much rhetoric of a big supply cut, but the best we got was a tepid “freeze”. I think crude will have immense problems getting through $35 unless things change on the global front, and slow growth doesn’t heal itself overnight. So I still think 25-35 is our range for the foreseeable future.

I have told you to watch the 1950 level on SPX since this rallied started, we are very close , but also keep in mind that the 50 day moving average is also just above at 1967 (green arrow).

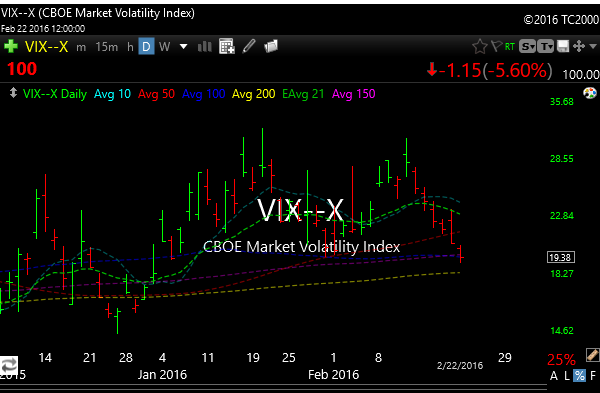

Meanwhile, people for now are doing a happy dance as the VIX is tanking and now under the 20 mark.

The McClellan Oscillator is getting close to overbought again. This needs to be watched closely because its been “money” in the past.

See you in the morning. Lets stay light on our loafers here and ready to act.