A rally that sent U.S. stocks to their biggest three-day rise since August faded today as investors resumed selling bank and energy stocks amid worries about uneven economic growth.

Energy and financial stocks in the S&P were among the biggest decliners, off 0.9% and 0.6%. The KBW Nasdaq Bank Index of large U.S. commercial banks fell 1.6%, down 17% for the year.

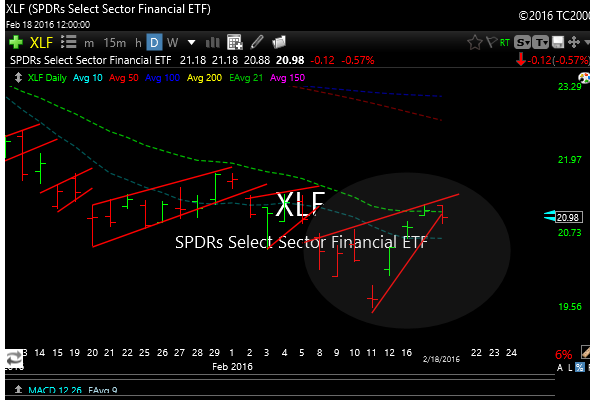

The charts on the financials generally look poor here and the chart of the financial etf (XLF) hit some resistance levels and backed off. Today’s little pullback was natural considering the rally that we have seen.

We haven seen many stops at all over the last few months, but today it looks like BBY and GPS stopped. If you happen to still be short let me tell you where I see the next resistance levels.

On BBY next levels are around 31.50 them 32.50. The second level is where it will hit some moving average congestion.

On GPS, resistance would be 27 then about 28.50

I do give stops some wiggle room on occasion, depending on volume and other factors and these same stocks may even be re-shorted again down the road, but a a lot will depend on the market.

Regarding Stops