The Dow added 183.12 points, after falling as much as 193 points earlier in the day. The S&P rose 9.5 points.

The S&P’s energy and materials sector indexes gained 4% and 3.3%, respectively, as oil prices surged

So total U.S. oil supplies stood at 502.7 million barrels a day for the week ended Jan. 29. The EIA said that’s “near levels not seen for this time of year in at least the last 80 years. So what did oil do? It rallied 8%. This is the kind of market that will take you out in a body bag if you’re not careful. Its becoming a 2+2=5 market a lot lately.

There were a few reasons for the oil rally, it was oversold, the dollar tanked (this stuff is priced in dollars remember), also, some attributed the bounce to renewed hopes that Russia ready to work with OPEC members, raising the prospect of a coordinated production cut. We have hard that one before, so don’t take that one to the bank. My takeaway? Its just manic right now.

Big bearish snap of the wedge for the greenback.

The market sold off hard today at the open, rallied a bit at around 10:45, retraced back until about 2PM then it launched another rally whereby it rallied 30 SPX handles. The Russell 2000 was barely up and the Nasdaq was down, so lets not get too excited here.

Short trade TREE fell apart yesterday and went a little lower today and our other short AMSG snapped that bear flag and dropped 7.3% today.

I added a few new shorts today:

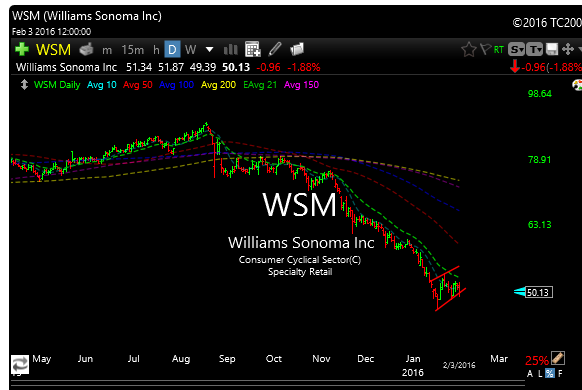

WSM-bear flag in play here.

BBY- back in this one again. Lovely bear wedge working.

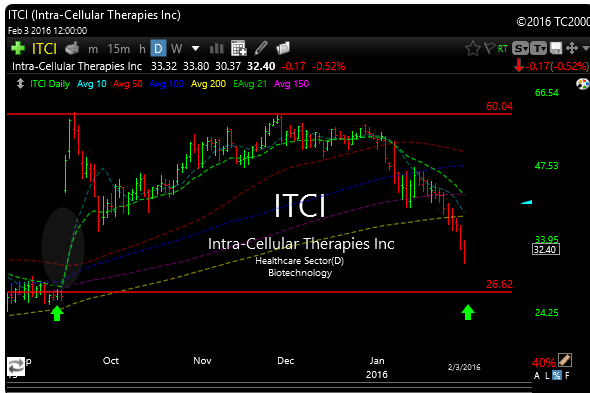

ITCI is breaking down and I’m looking for it to fill the gap around 26-27

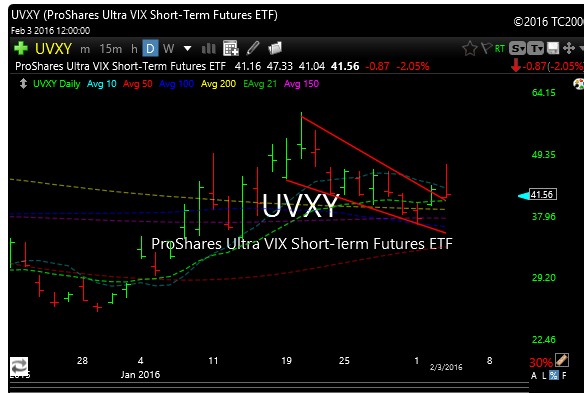

I also added UVXY. If we get a leg down, I would look for the VIX and UVXY to explode higher. I really like that bullish wedge. It had a really nice move today until the market reversed and rallied.

See you in the morning. I’m still cautious on this market.